941 Reconciliation Template Excel

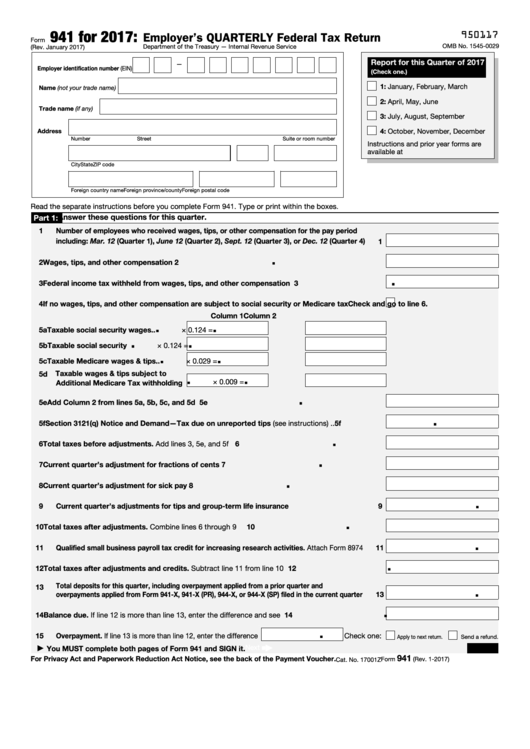

941 Reconciliation Template Excel - Web payroll reconciliation is the process of comparing your payroll register with the amount you plan to pay your. Web form 941 worksheet for 2022. If these forms are not in balance, penalties from the irs. Save or instantly send your ready documents. Use on any account, petty cash, ledger, or. Web ein, “form 941,” and the tax period (“1st quarter 2022,” “2nd quarter 2022,” “3rd quarter 2022,” or “4th quarter 2022”) on. The register should show wages and deductions for each employee during that. Web go to www.irs.gov/form941 for instructions and the latest information. Web 941 irs excel template. Web this simple bank reconciliation template is designed for personal or business use, and you can download it as. If these forms are not in balance, penalties from the irs. I have found many 941 pdf fillers but was wondering if anybody had an excel format. The register should show wages and. Run a payroll register for the quarter. The register should show wages and deductions for each employee during that. Web make reconciliation documents with template.net's free reconciliation templates excel. Web this simple bank reconciliation template is designed for personal or business use, and you can download it as. The register should show wages and deductions for each employee during that. The register should show wages and. Web 941 irs excel template. I have found many 941 pdf fillers but was wondering if anybody had an excel format. Web completion of the payroll reconciliation usually results in more accurate payroll wages and taxes reported on quarterly. Run a payroll register for the quarter. Save or instantly send your ready documents. Web go to www.irs.gov/form941 for instructions and the latest information. I have found many 941 pdf fillers but was wondering if anybody had an excel format. Web payroll reconciliation is the process of comparing your payroll register with the amount you plan to pay your. Web make reconciliation documents with template.net's free reconciliation templates excel. Use on any account, petty cash, ledger, or. Web the following instructions provide best practice. Web this simple bank reconciliation template is designed for personal or business use, and you can download it as. The register should show wages and. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. Run a payroll register for the quarter. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Web ein, “form 941,” and the tax period (“1st quarter 2022,” “2nd quarter 2022,” “3rd quarter 2022,” or “4th quarter 2022”) on. Web forms and instructions about form 941, employer's quarterly federal tax return employers use form 941 to: Web quarterly 941 reconciliation. Web go to www.irs.gov/form941 for instructions and the. Read the separate instructions before you complete form. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. Web 941 irs excel template. Web quarterly 941 reconciliation. If these forms are not in balance, penalties from the irs. Web 941 irs excel template. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020. Web forms and instructions about form 941, employer's quarterly federal tax return employers use form 941 to: Web the following instructions provide best practice guidance for individuals responsible for reconciling balance sheet. The register should. Use on any account, petty cash, ledger, or. I have found many 941 pdf fillers but was wondering if anybody had an excel format. Web payroll reconciliation is the process of comparing your payroll register with the amount you plan to pay your. Web completion of payroll reconciliation usually results in more accurate payroll wages and taxes reported on quarterly. The register should show wages and deductions for each employee during that. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. Web go to www.irs.gov/form941 for instructions and the latest information. Use on any account, petty cash, ledger, or. Web form 941 worksheet for 2022. Save or instantly send your ready documents. Web the following instructions provide best practice guidance for individuals responsible for reconciling balance sheet. Run a payroll register for the quarter. The register should show wages and deductions for each employee during that. Web this simple bank reconciliation template is designed for personal or business use, and you can download it as. Web completion of payroll reconciliation usually results in more accurate payroll wages and taxes reported on quarterly forms 941 or. Use on any account, petty cash, ledger, or. Web 941 irs excel template. Web completion of the payroll reconciliation usually results in more accurate payroll wages and taxes reported on quarterly. The register should show wages and. Web go to www.irs.gov/form941 for instructions and the latest information. Read the separate instructions before you complete form. Web forms and instructions about form 941, employer's quarterly federal tax return employers use form 941 to: Web form 941 worksheet for 2022. Web payroll reconciliation is the process of comparing your payroll register with the amount you plan to pay your. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. Easily fill out pdf blank, edit, and sign them. If these forms are not in balance, penalties from the irs. Web ein, “form 941,” and the tax period (“1st quarter 2022,” “2nd quarter 2022,” “3rd quarter 2022,” or “4th quarter 2022”) on.QuickBooks Payroll Liability reports and troubleshooting

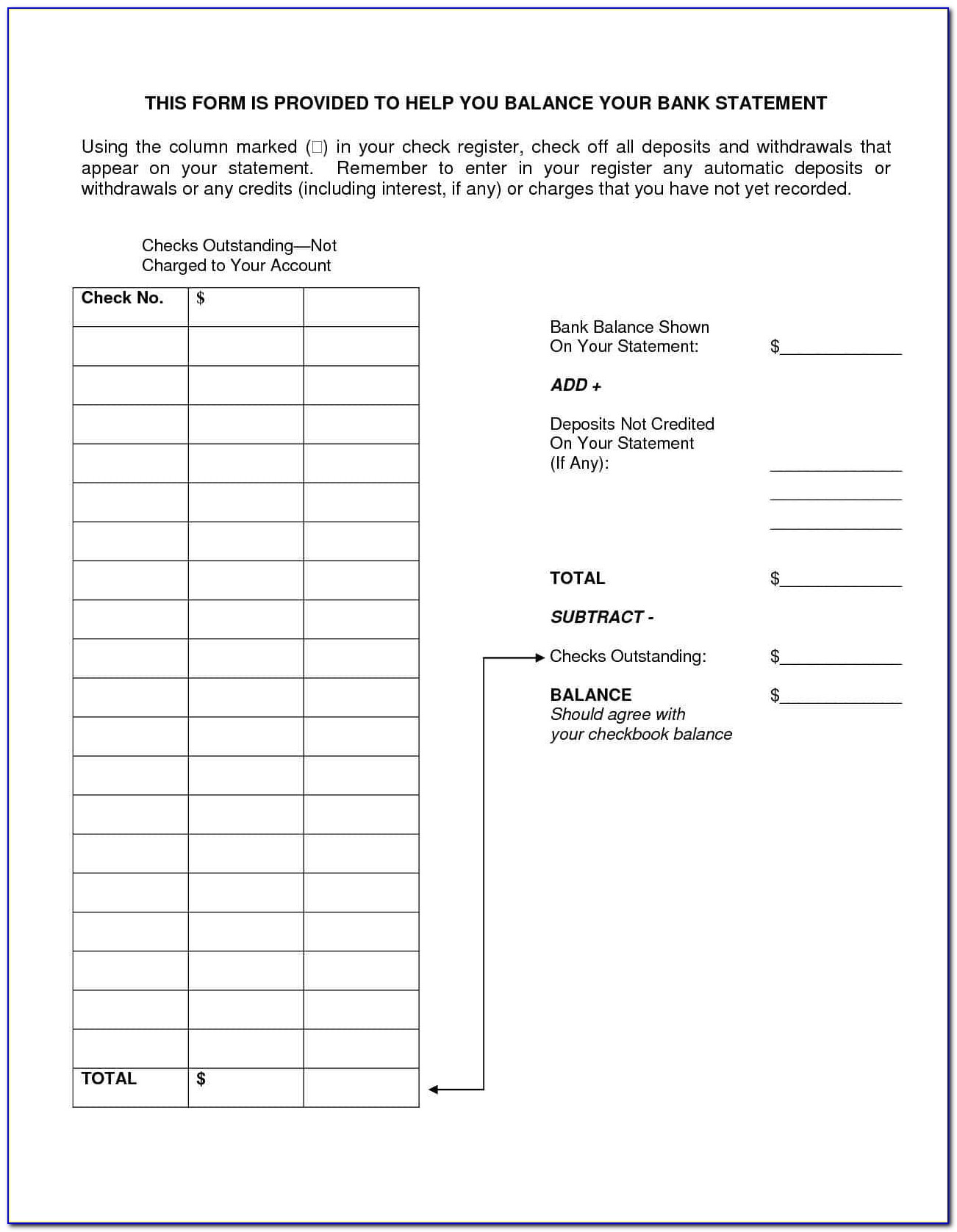

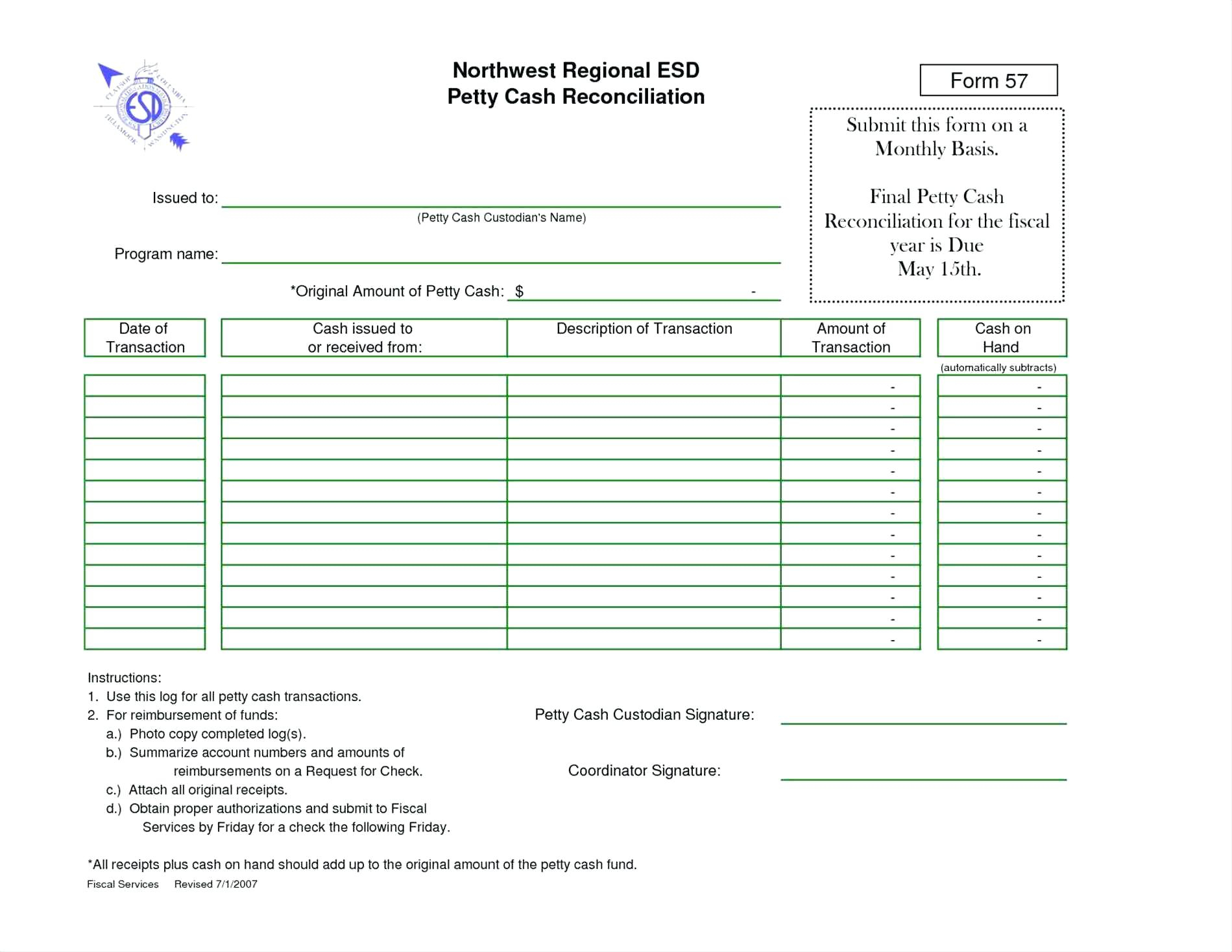

Daily Cash Reconciliation Worksheet Daily Petty Cash Reconciliation

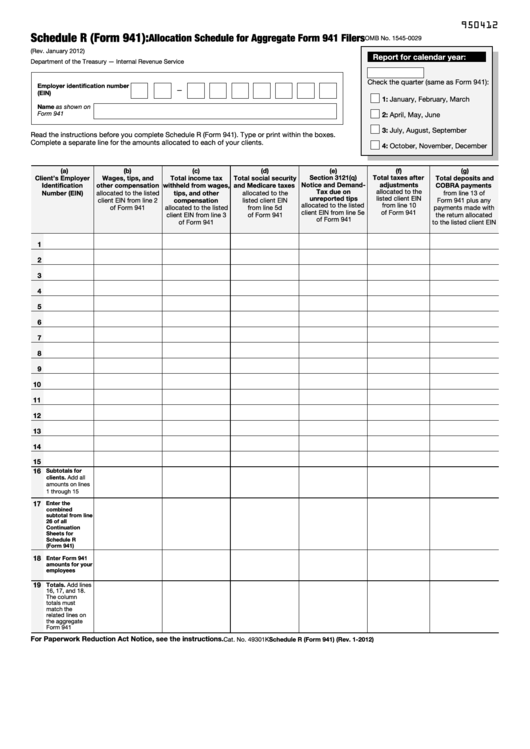

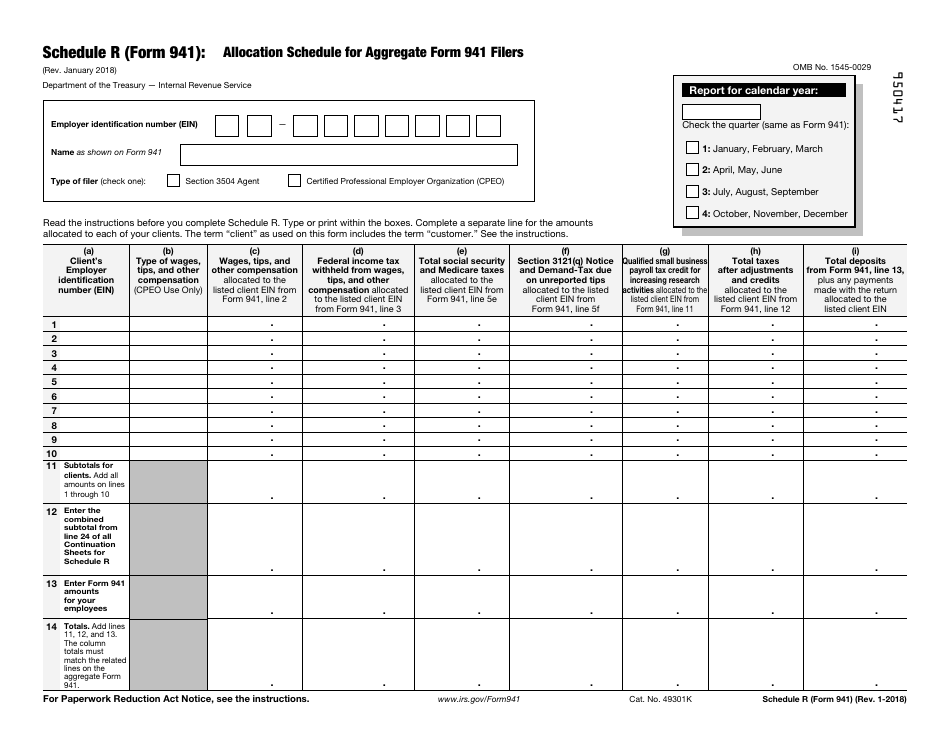

Fillable Schedule R (Form 941) Allocation Schedule For Aggregate Form

Inventory Reconciliation Format In Excel Excel Templates

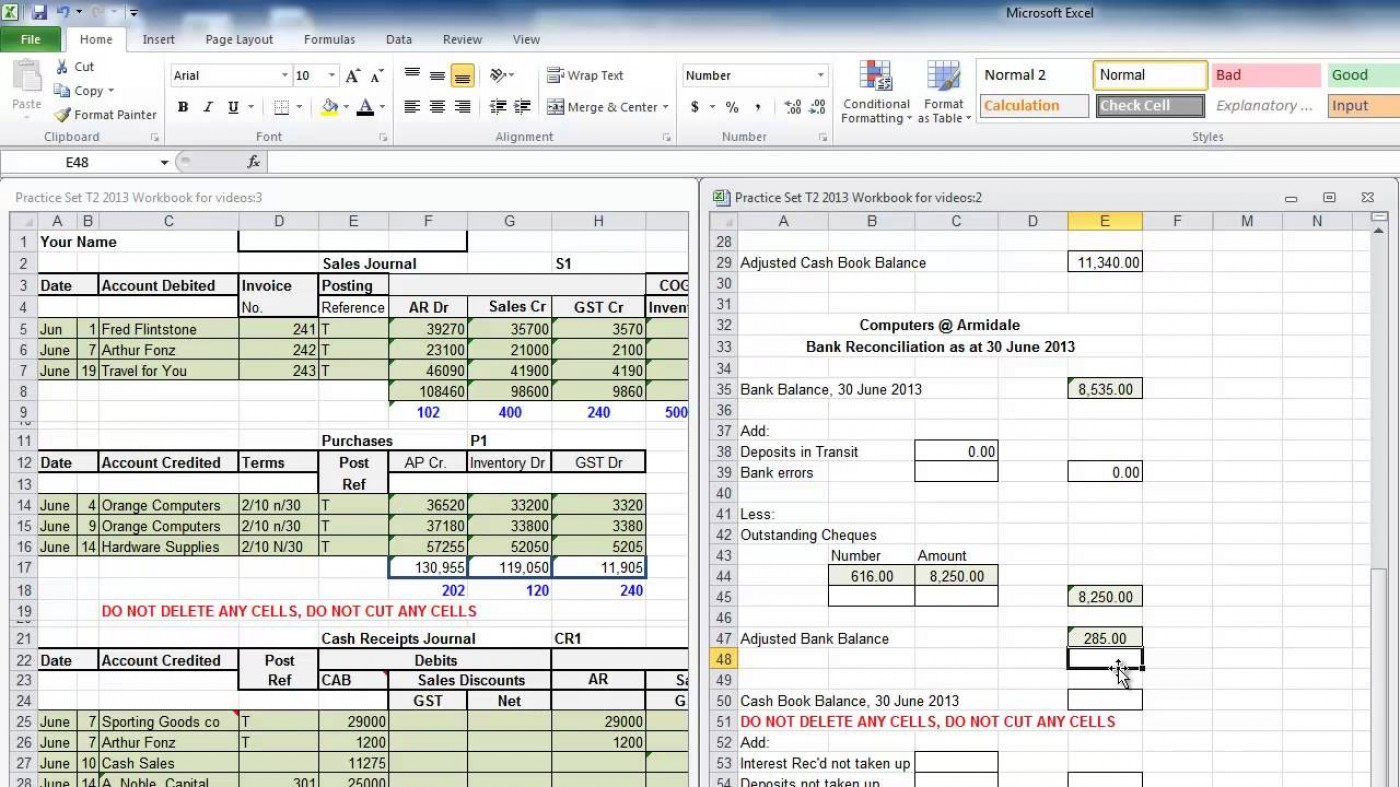

Bank Reconciliation Excel Spreadsheet Google Spreadshee bank

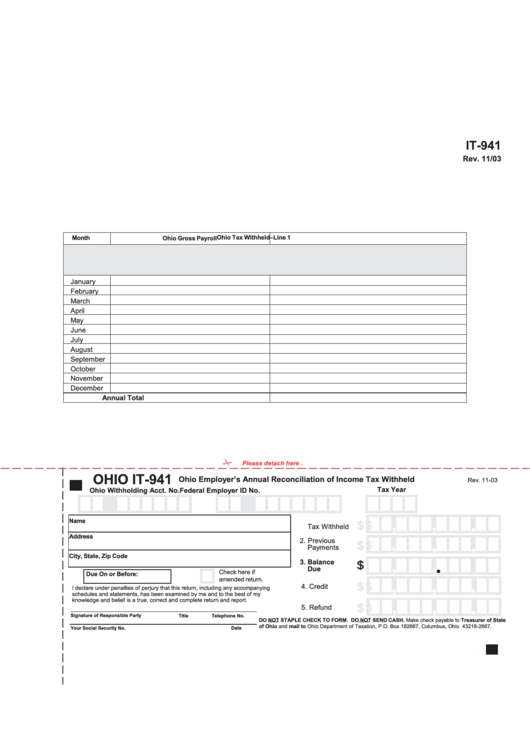

Form It941 Employer'S Annual Reconciliation Of Tax Withheld

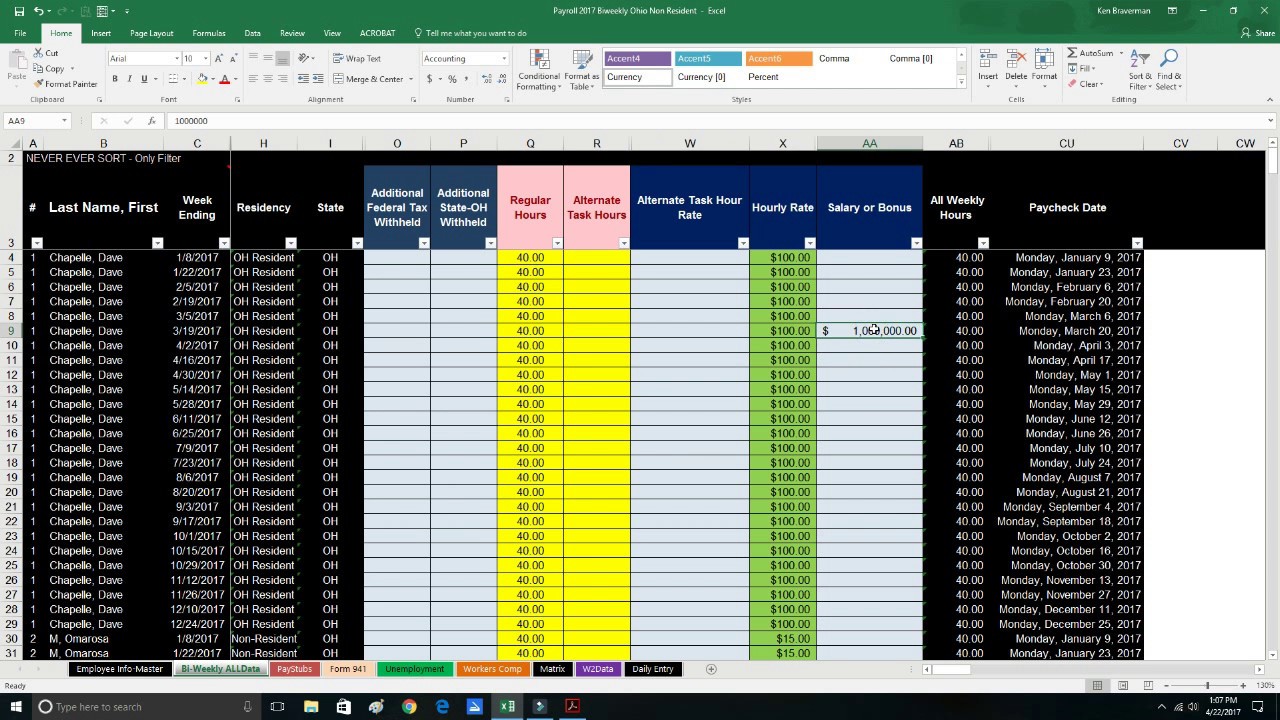

How to File Quarterly Form 941 Payroll in Excel 2017 YouTube

941x Worksheet 2 Excel

IRS Form 941 Schedule R Download Fillable PDF or Fill Online Allocation

106 Form 941 Templates free to download in PDF, Word and Excel

Related Post: