Asc 842 Lease Template Excel Free

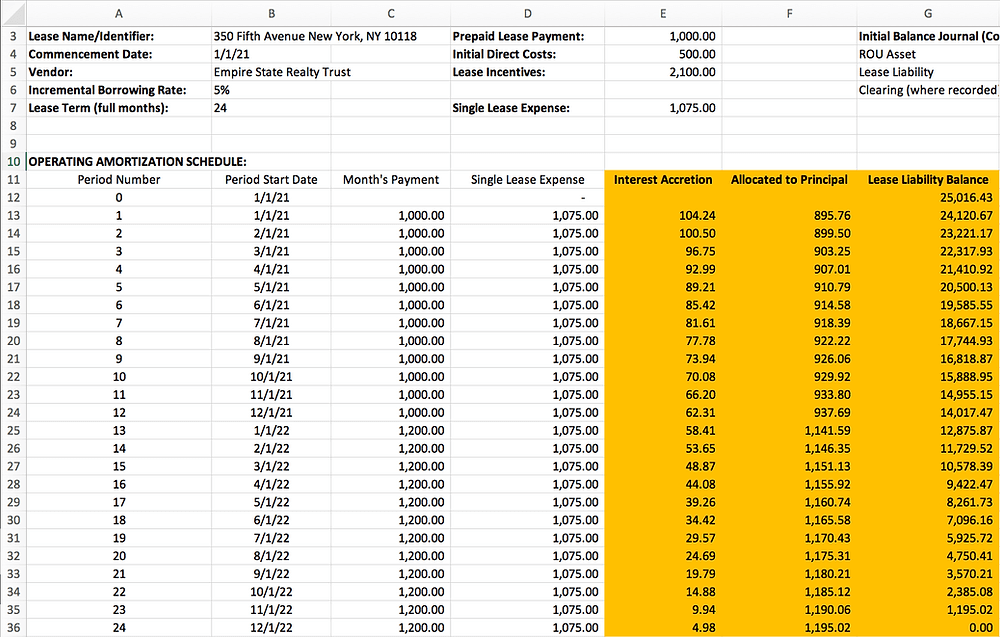

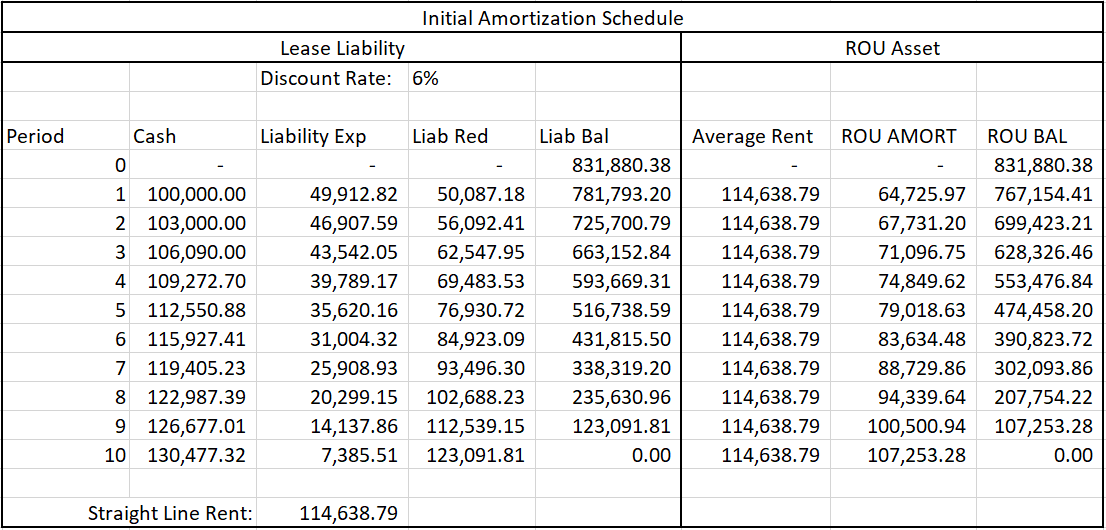

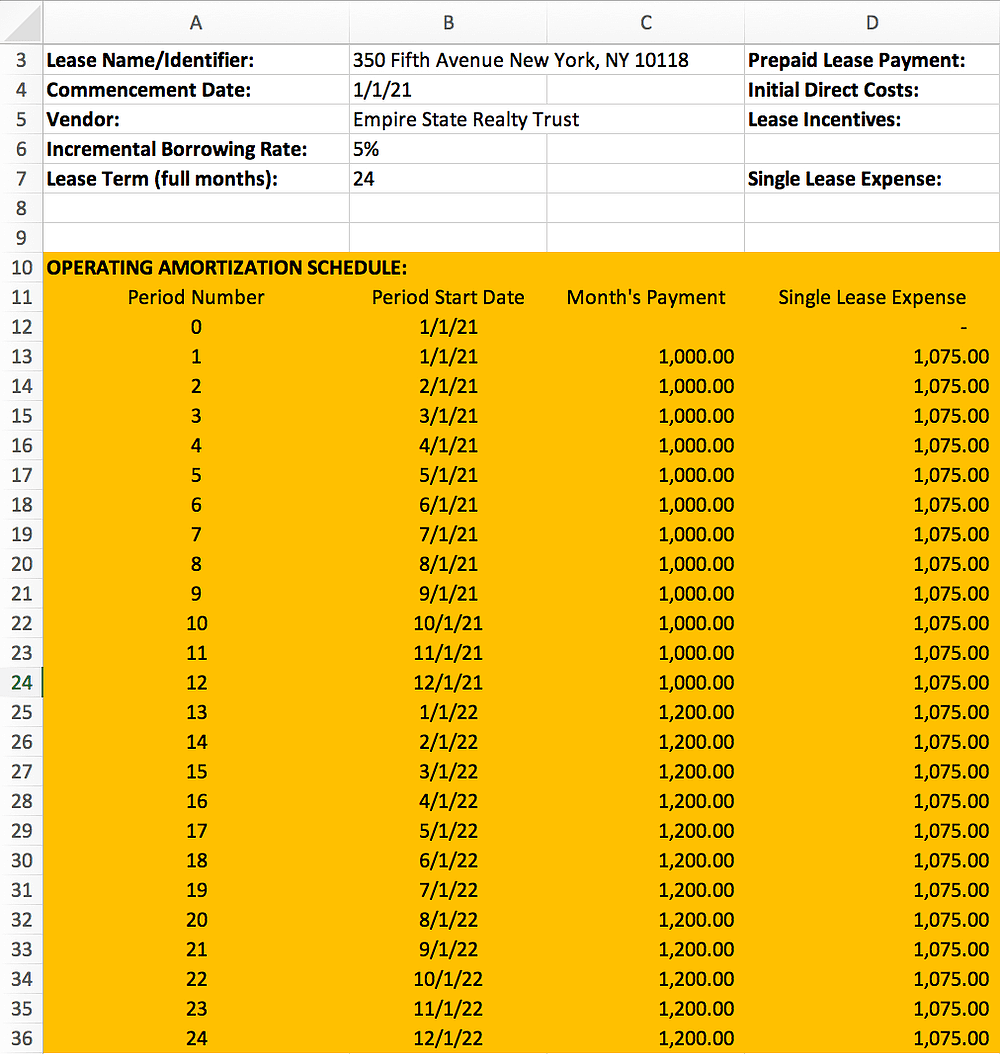

Asc 842 Lease Template Excel Free - Web with this lease amortization schedule you will be able to : Web what does our lease classification template cover? What is a lease under asc 842? Those columns will be called. Click the link to download a template for asc 842. Web we unpack hot topics in lease accounting under asc 842 and considerations for entities that haven’t yet adopted the new. Web under asc 842, operating leases and financial leases have different amortization calculations. Web this solution will suffice for entities with around a dozen or less leases or a cpa firm validating client provided lease calculations. Asc 842 effective dates effective date for public companies. Web if you enter the number “0”, this will adjust the present value calculation to assume lease payments are made at the end of. We’ve created an excel spreadsheet that walks you through the testing requirements step. Web asc 842 requires lessees to bring all leases on the balance sheet. Web larson lease accounting template asc 842. Web we unpack hot topics in lease accounting under asc 842 and considerations for entities that haven’t yet adopted the new. Refer below for seven steps on. The scope of asc 842 is substantially the same as asc 840. Refer below for seven steps on how to calculate the lease. Web we unpack hot topics in lease accounting under asc 842 and considerations for entities that haven’t yet adopted the new. Create an excel spreadsheet with. With our excel template, you will be. Web asc 842 embedded lease assessment template for lessees. Web a lease liability is required to be calculated for both asc 842 & ifrs 16. Web with this lease amortization schedule you will be able to : Create an excel spreadsheet with. Asc 842 effective dates effective date for public companies. The user merely answers the lease. Create an excel spreadsheet with. Web use this free tool to determine if your leases are classified as finance or operating leases under asc 842. Web a lease liability is required to be calculated for both asc 842 & ifrs 16. Asc 842 effective dates effective date for public companies. Web asc 842 embedded lease assessment template for lessees. The scope of asc 842 is substantially the same as asc 840. Those columns will be called. The user merely answers the lease. Web under asc 842, operating leases and financial leases have different amortization calculations. Web what does our lease classification template cover? Asc 842 transition blueprint & workbook; Those columns will be called. With our excel template, you will be. Web discount rate implicit in the lease under asc 842 interest rate implicit in the lease under ifrs 16 step 1: Web this downloadable resource addresses high level lease standard questions that may come up as firms and organizations check. Web this solution will suffice for entities with around a dozen or less leases or a cpa firm validating client provided lease calculations. Web a lease liability is required to be calculated for both asc 842 & ifrs 16. Refer below. Web this solution will suffice for entities with around a dozen or less leases or a cpa firm validating client provided lease calculations. Web what does our lease classification template cover? Click the link to download a template for asc 842. Asc 842 effective dates effective date for public companies. We’ve created an excel spreadsheet that walks you through the. Web our review template offers a clear process and guidance for applying asc 842 lease accounting standards to leases. Web a lease liability is required to be calculated for both asc 842 & ifrs 16. Web download our free asc 842 lease accounting calculator and calculate the accounting impact of leases under new lease. Web use this free tool to. Web under asc 842, operating leases and financial leases have different amortization calculations. The user merely answers the lease. By adam olsen, cpa* | march 21, 2022. Asc 842 transition blueprint & workbook; We’ve created an excel spreadsheet that walks you through the testing requirements step. Embedded lease test use this free tool to. Create an excel spreadsheet with. Click the link to download a template for asc 842. Web download our free asc 842 lease accounting calculator and calculate the accounting impact of leases under new lease. Those columns will be called. Web under asc 842, operating leases and financial leases have different amortization calculations. Web asc 842 requires lessees to bring all leases on the balance sheet. Web this downloadable resource addresses high level lease standard questions that may come up as firms and organizations check. Web we unpack hot topics in lease accounting under asc 842 and considerations for entities that haven’t yet adopted the new. Web asc 842 embedded lease assessment template for lessees. The scope of asc 842 is substantially the same as asc 840. Web our review template offers a clear process and guidance for applying asc 842 lease accounting standards to leases. The user merely answers the lease. What is a lease under asc 842? Web technical accounting asc 842 lease classification template for lessees by clancy fossum, cpa* | november 15,. Web this solution will suffice for entities with around a dozen or less leases or a cpa firm validating client provided lease calculations. Web larson lease accounting template asc 842. With our excel template, you will be. Asc 842 transition blueprint & workbook; Web a lease liability is required to be calculated for both asc 842 & ifrs 16.ASC 842 Lease Amortization Schedule Templates in Excel Free Download

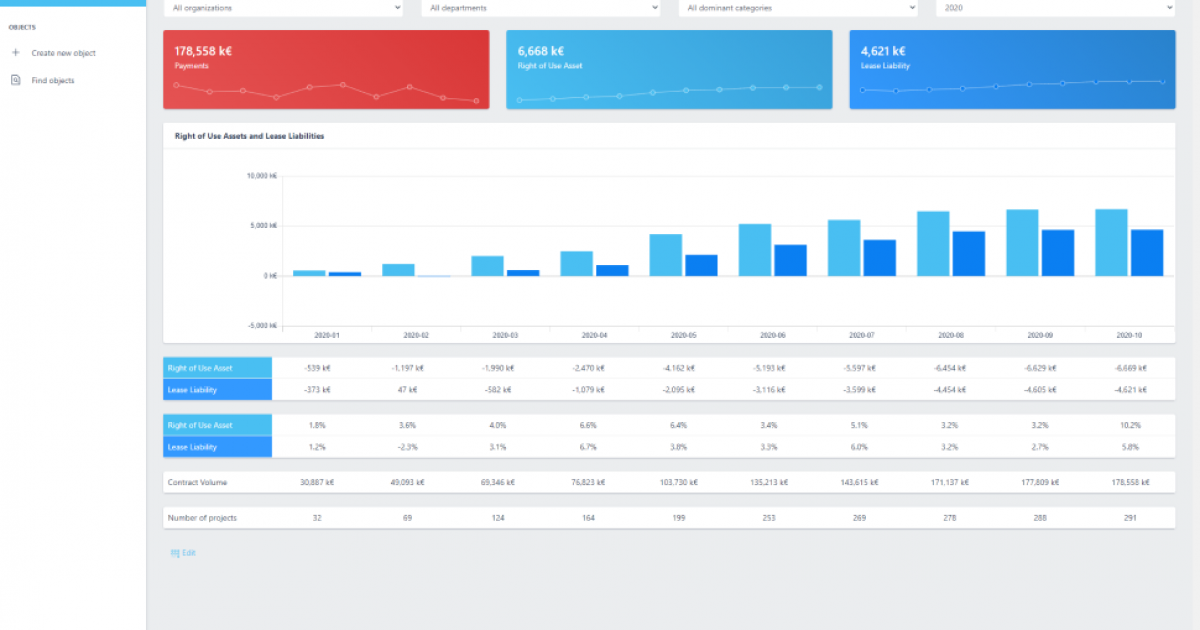

Sensational Asc 842 Excel Template Dashboard Download Free

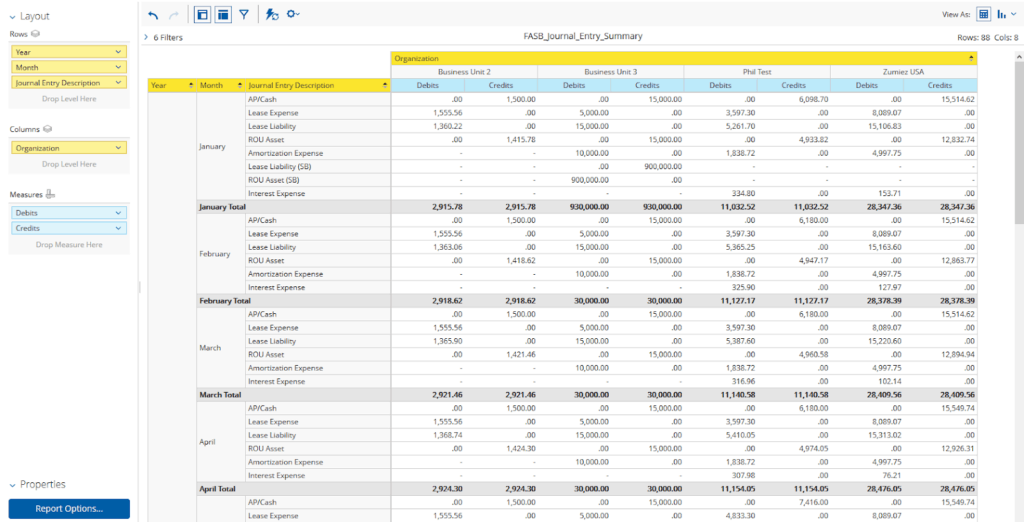

ASC 842 Journal Entries for Finance & Operating Leases Visual Lease

Lease Modification Accounting for ASC 842 Operating to Operating

Puñado Ver a través de Decir calculo leasing excel Soldado Disponible genio

Excel Solution

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Sensational Asc 842 Excel Template Dashboard Download Free

ASC 842 Excel Template Download

Asc 842 Operating Lease Excel Template templates.iesanfelipe.edu.pe

Related Post: