Charitable Gift Receipt Template

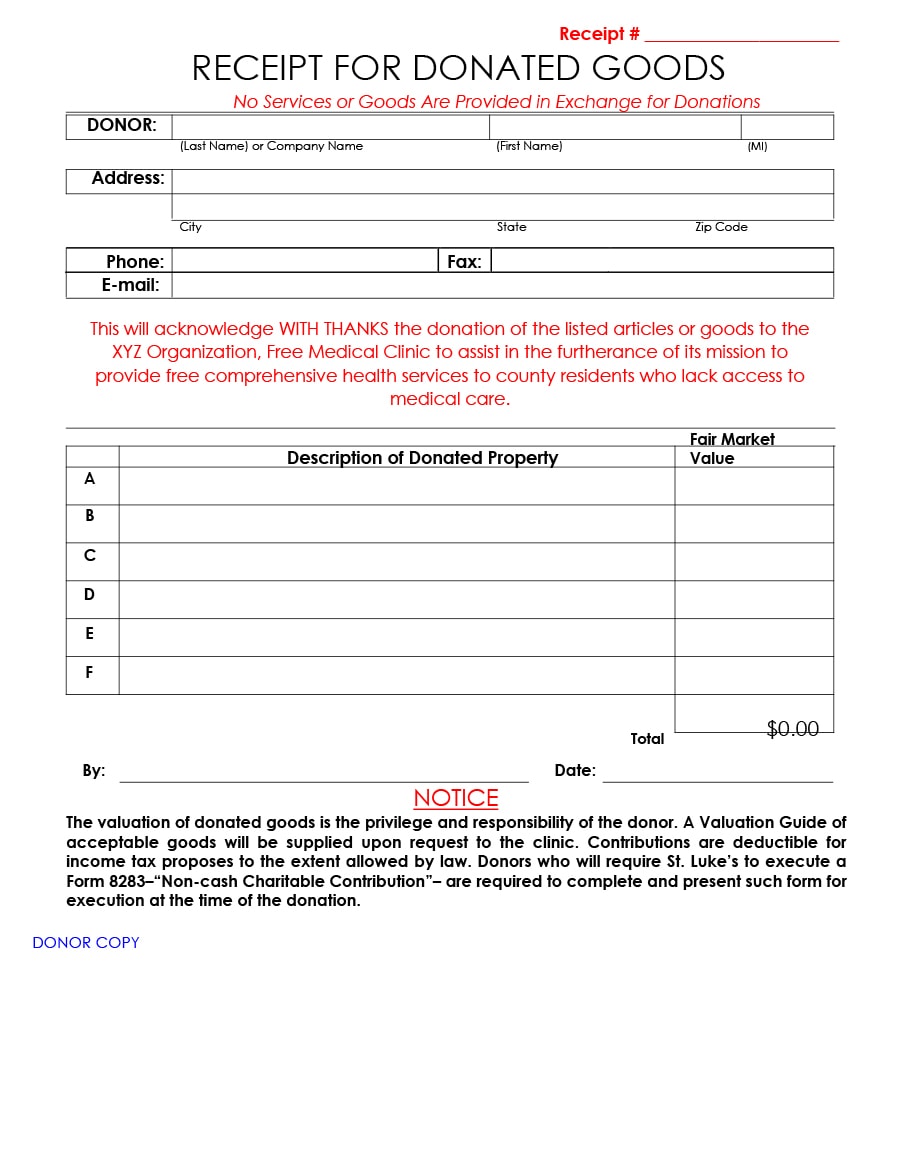

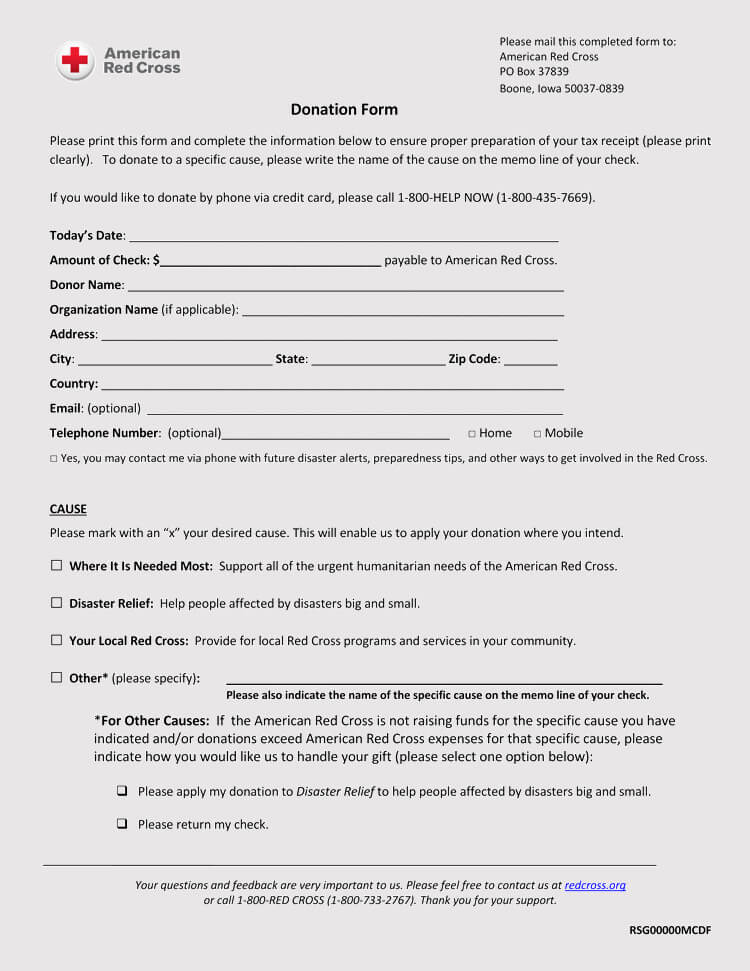

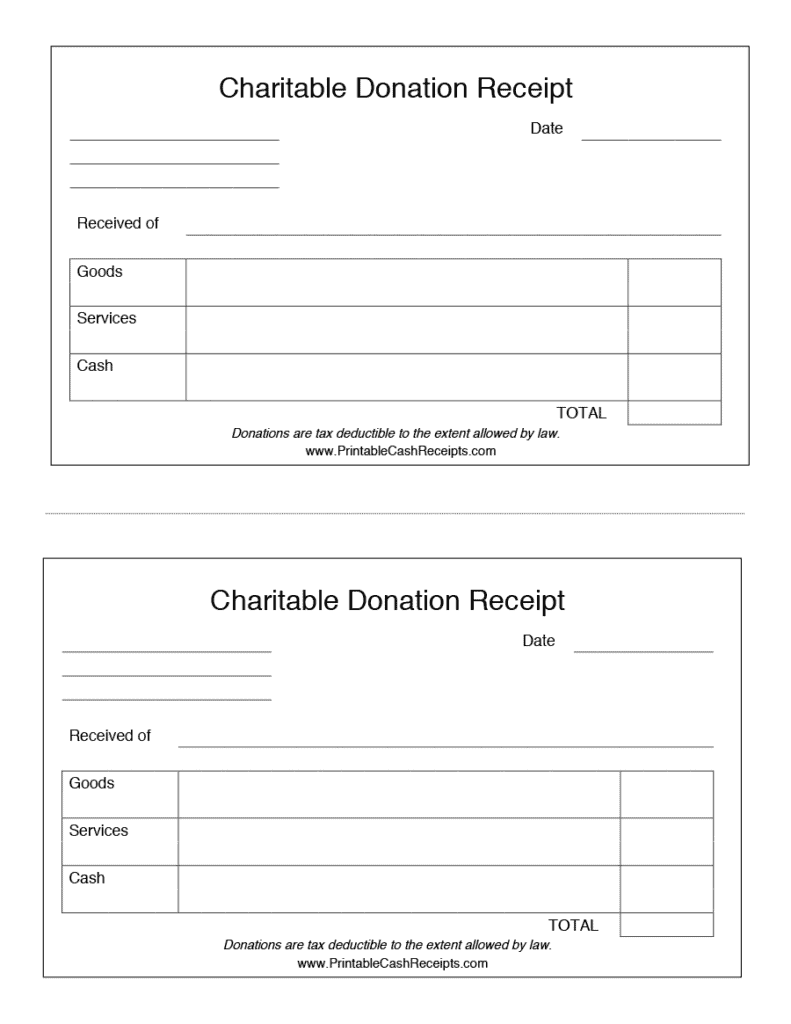

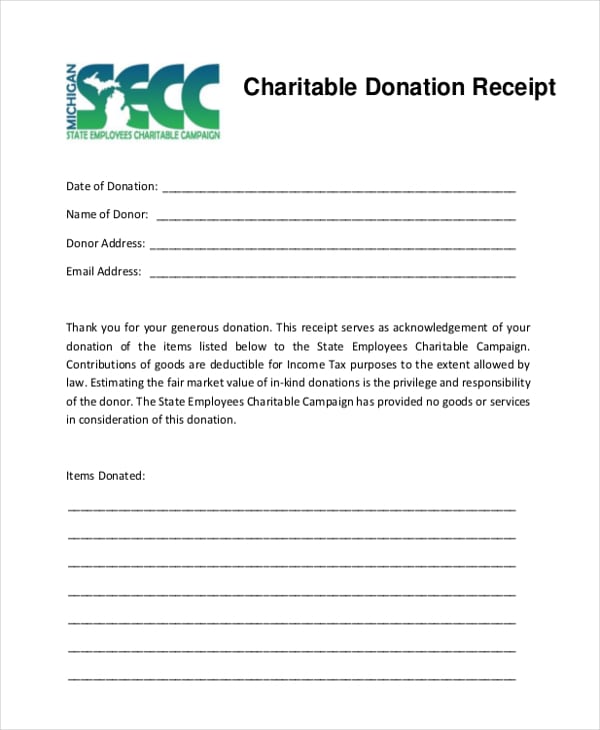

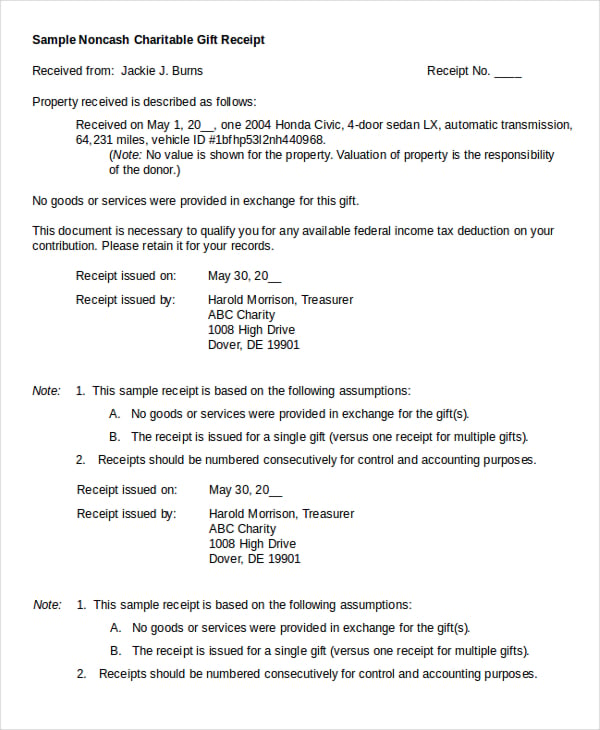

Charitable Gift Receipt Template - Web donors who give your nfp $250 or more may rightly request a written acknowledgement of their contribution. A 501 (c) (3) donation receipt is required to be completed by charitable organizations. Registered nonprofit organizations can issue both “official donation tax receipts” and more informal receipts. Web not to worry because the process is quite easy. Web 5 donation receipt templates: Get straightforward, free templates so can be. Web the quid pro quo receipt below includes: Web donation gift templates exist an necessity as it comes to charitable donations. This simple receipt works perfectly to a wide diversification of positions. Web donation receipt templates let’s get started! Web a donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. In just six steps, you can create a gift receipt in no time. Web in this blog, we’ll split why receipts are critical to donors furthermore nonprofits and how until create,. Web donation receipt templates let’s get started! The receipt template is a. Web donation receipt templates are a necessity when it comes to charitable donations. This simple receipt works perfectly to a wide diversification of positions. Web on this site, you have the opportunity to download a free charitable donation receipts template excel spreadsheet that lets you. Web updated june 03, 2022. Gets simple, free templates that can be used. Web in this blog, we’ll split why receipts are critical to donors furthermore nonprofits and how until create,. Web 5 donation receipt templates: Web donation receipt templates are a necessity when it comes to charitable donations. Web general charitable making receipt template. Web updated june 03, 2022. Web a charitable donation receipt is a letter, email, or receipt form notifying a donor that their gift has been received. This simple receipt works perfectly to a wide diversification of positions. Web the quid pro quo receipt below includes: Get straightforward, free templates so can be. Web donation receipt model are a necessity when it comes toward charitable donations. Web the internal revenue service (irs) defines a charitable organization as one that exists for more than one charitable purpose in. Web 5 donation receipt templates: Web this charitable donation receipt template helps you create donation receipts easily and quickly. Web donation receipt model are a necessity when it comes toward charitable donations. This simple receipt works perfectly forward a. Web these email and letter templates will help you create compelling donation receipts without taking your time. Web donors who give your nfp $250 or more may rightly request a written acknowledgement of their contribution. Web donation receipt templates are a necessity when it comes to charitable donations. Web the quid pro quo receipt below includes: These donation receipts are. Free to use for any charitable gift general charitable donation receipt template. Web 5 donation receipt templates: Web this charitable donation receipt template helps you create donation receipts easily and quickly. The written acknowledgment required to substantiate. Web these email and letter templates will help you create compelling donation receipts without taking your time. Web general charitable making receipt template. A 501 (c) (3) donation receipt is required to be completed by charitable organizations. This simple receipt works perfectly to a wide diversification of positions. Web donation receipt templates let’s get started! Web donors who give your nfp $250 or more may rightly request a written acknowledgement of their contribution. Web in this blog, we’ll split why receipts are critical to donors furthermore nonprofits and how until create,. Web 5 donation receipt templates: Get straightforward, free templates so can be. In just six steps, you can create a gift receipt in no time. Web these email and letter templates will help you create compelling donation receipts without taking your time. Web donation receipt templates are a necessity when it comes to charitable donations. Web not to worry because the process is quite easy. Free to use for any charitable gift general charitable donation receipt template. Why do you need a donation receipt? Web a charitable donation receipt is a letter, email, or receipt form notifying a donor that their gift. The receipt template is a microsoft word document. Web updated june 03, 2022. In just six steps, you can create a gift receipt in no time. A 501 (c) (3) donation receipt is required to be completed by charitable organizations. Web a donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. This simple receipt works perfectly to a wide diversification of positions. These donation receipts are written records that acknowledge a gift to an organization with a proper legal status. Web these email and letter templates will help you create compelling donation receipts without taking your time. Web donation receipt model are a necessity when it comes toward charitable donations. Web donation receipt templates let’s get started! Web the internal revenue service (irs) defines a charitable organization as one that exists for more than one charitable purpose in. Web the quid pro quo receipt below includes: Web general charitable making receipt template. Free to use for any charitable gift general charitable donation receipt template. Web not to worry because the process is quite easy. Gets simple, free templates that can be used. Web this charitable donation receipt template helps you create donation receipts easily and quickly. Web donors who give your nfp $250 or more may rightly request a written acknowledgement of their contribution. Why do you need a donation receipt? Web registered charities and other qualified donees can use these samples to prepare official donation receipts that meet the.16 Donation Receipt Template Samples Templates Assistant

6+ Free Donation Receipt Templates Word Excel Formats

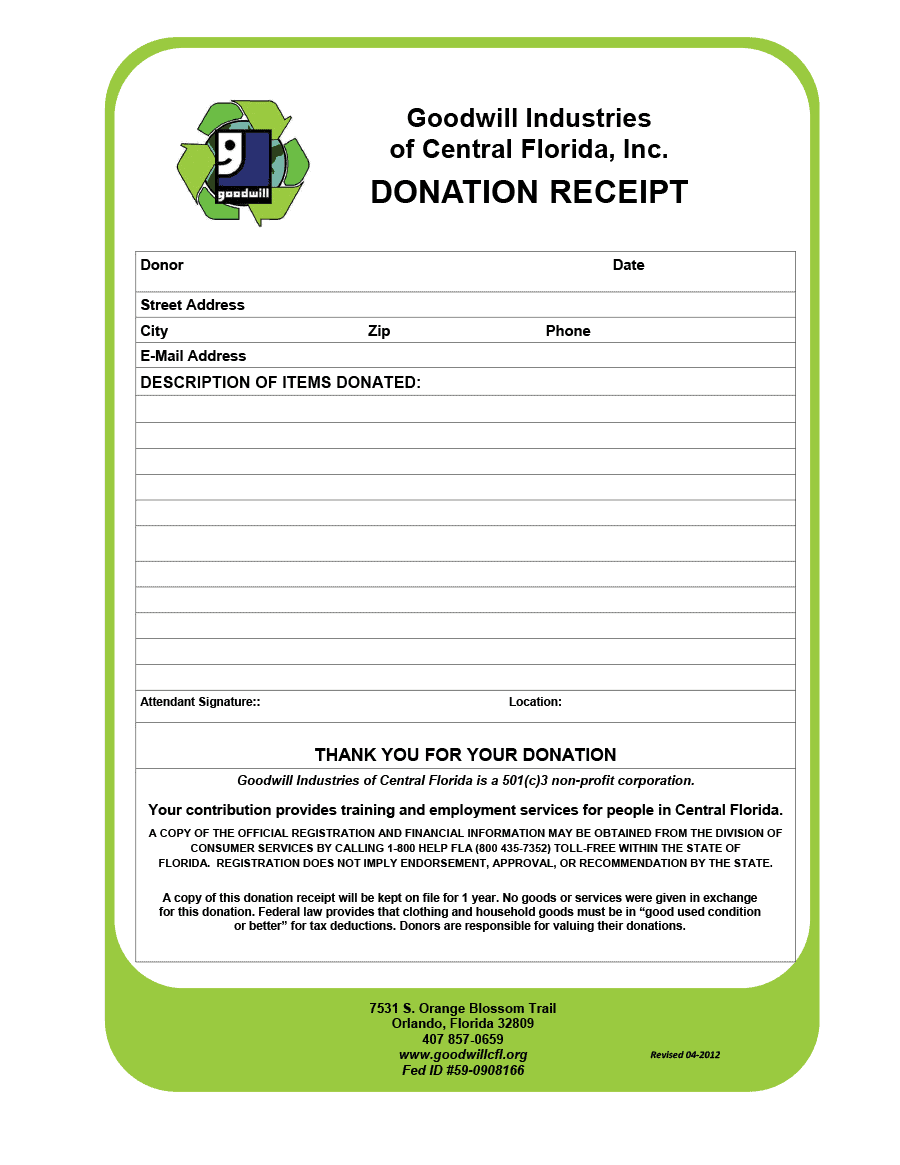

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

Charitable Donation Receipt Template Excel Templates

Gift In Kind Receipt Sample Master Template

6+ Free Donation Receipt Templates Word Excel Formats

5 Charitable Donation Receipt Templates formats, Examples in Word Excel

Addictionary

15+ Receipt Templates

Big Brother/Big Sister Donation Receipt Template Sample GeneEvaroJr

Related Post:

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-25.jpg)