Company Valuation Excel Template Free

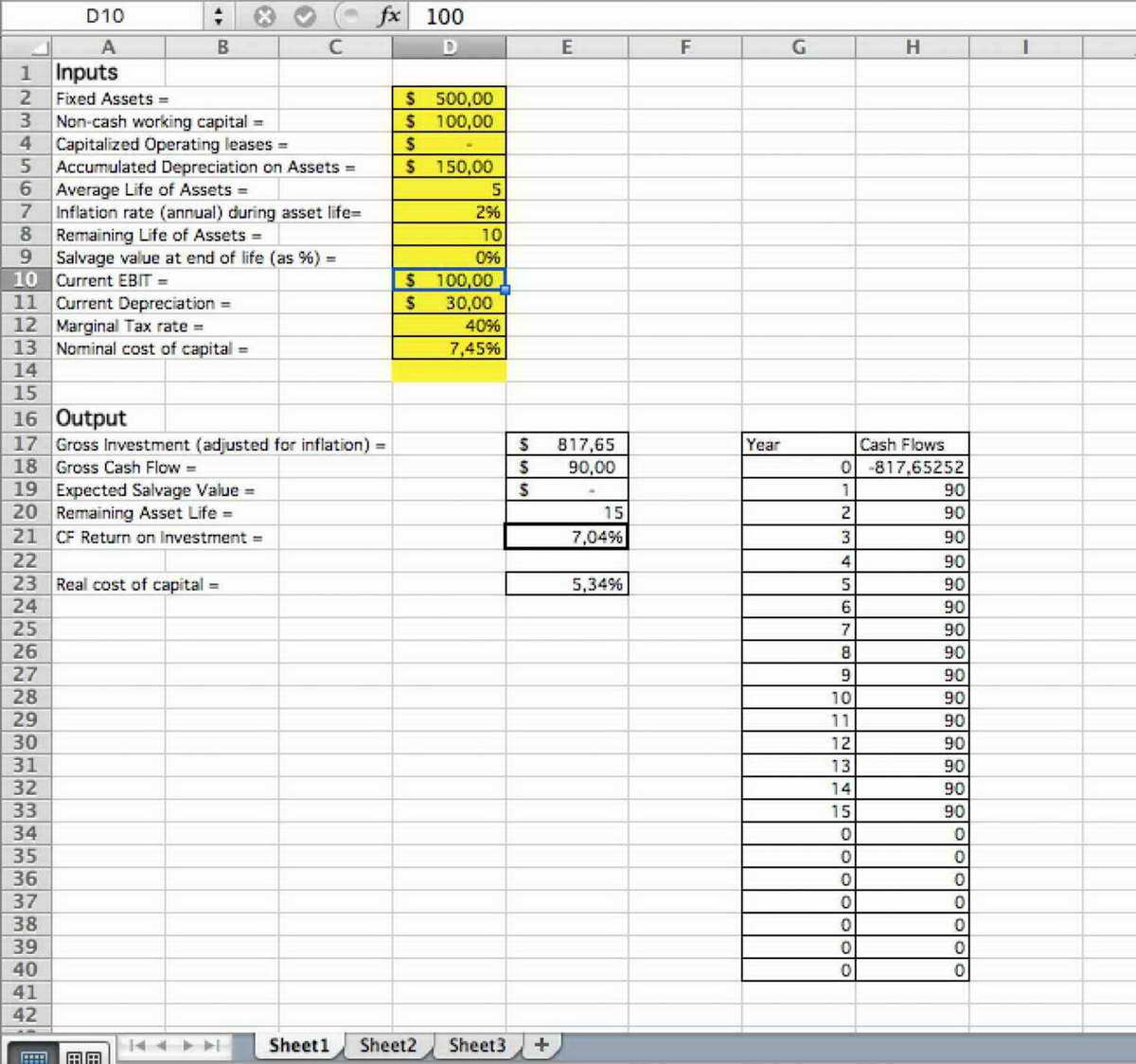

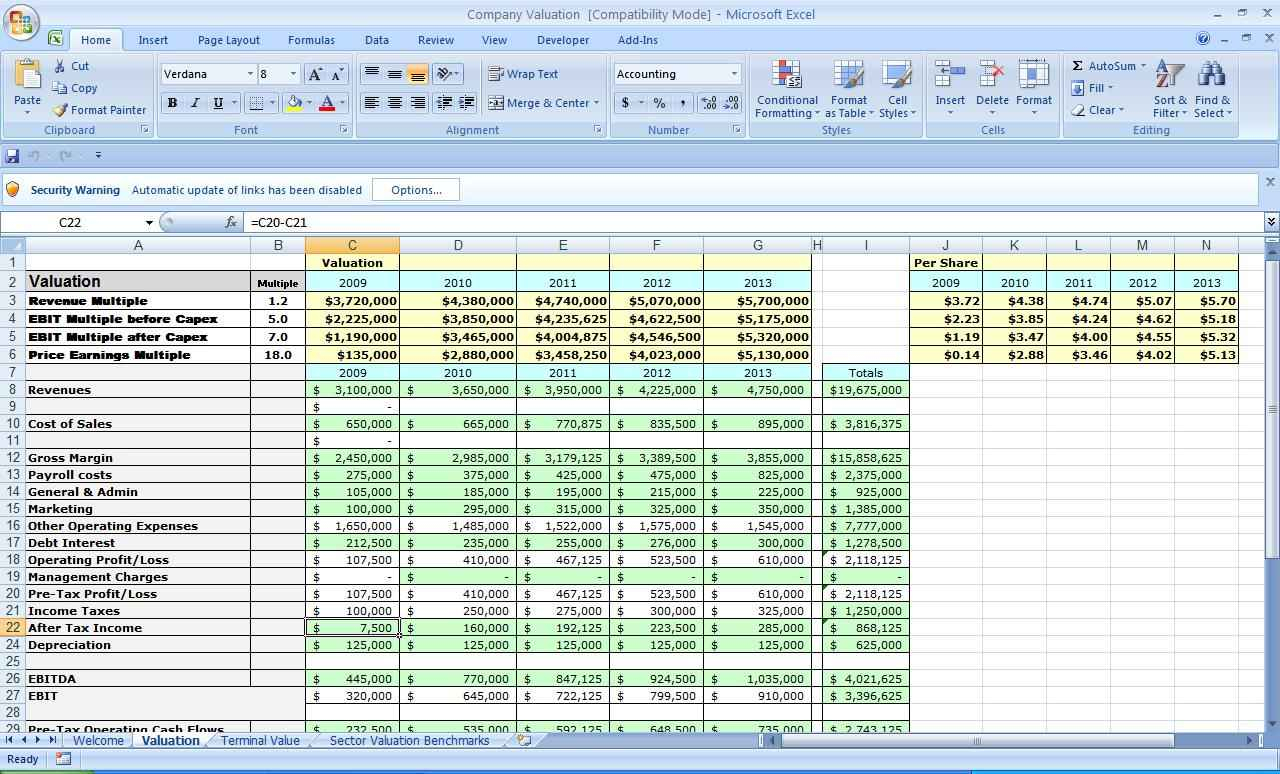

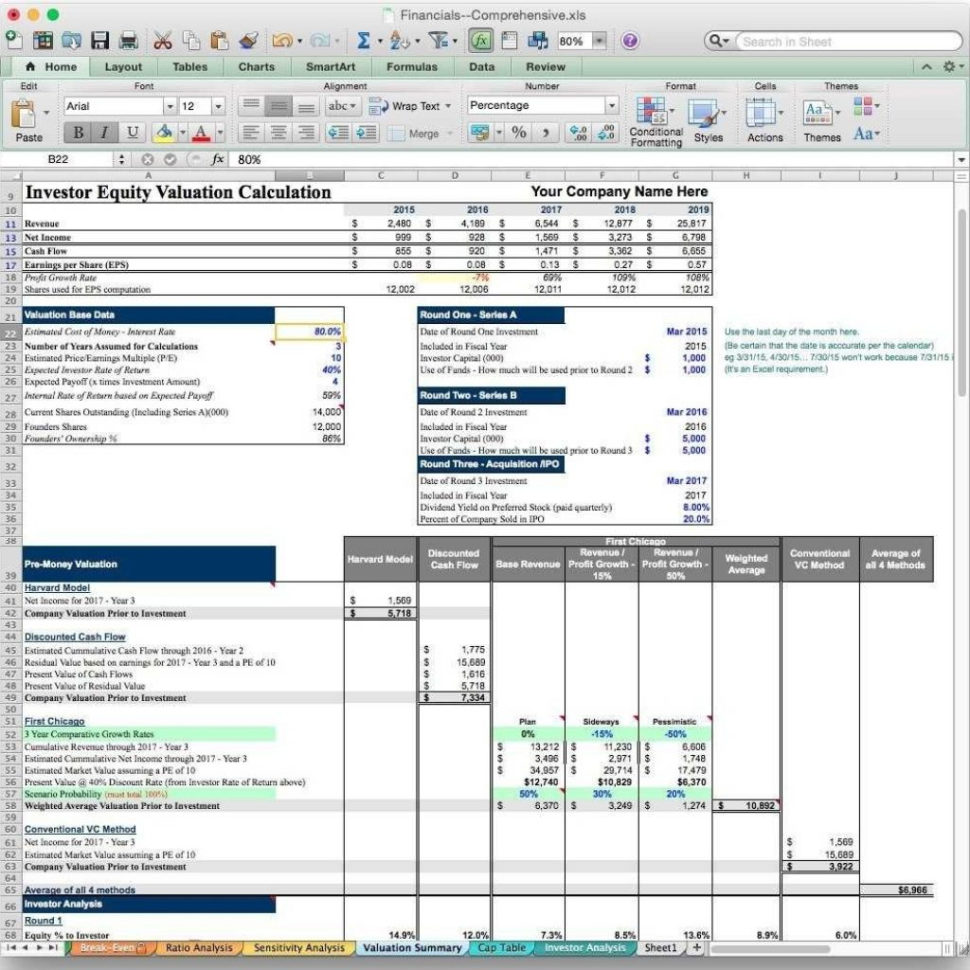

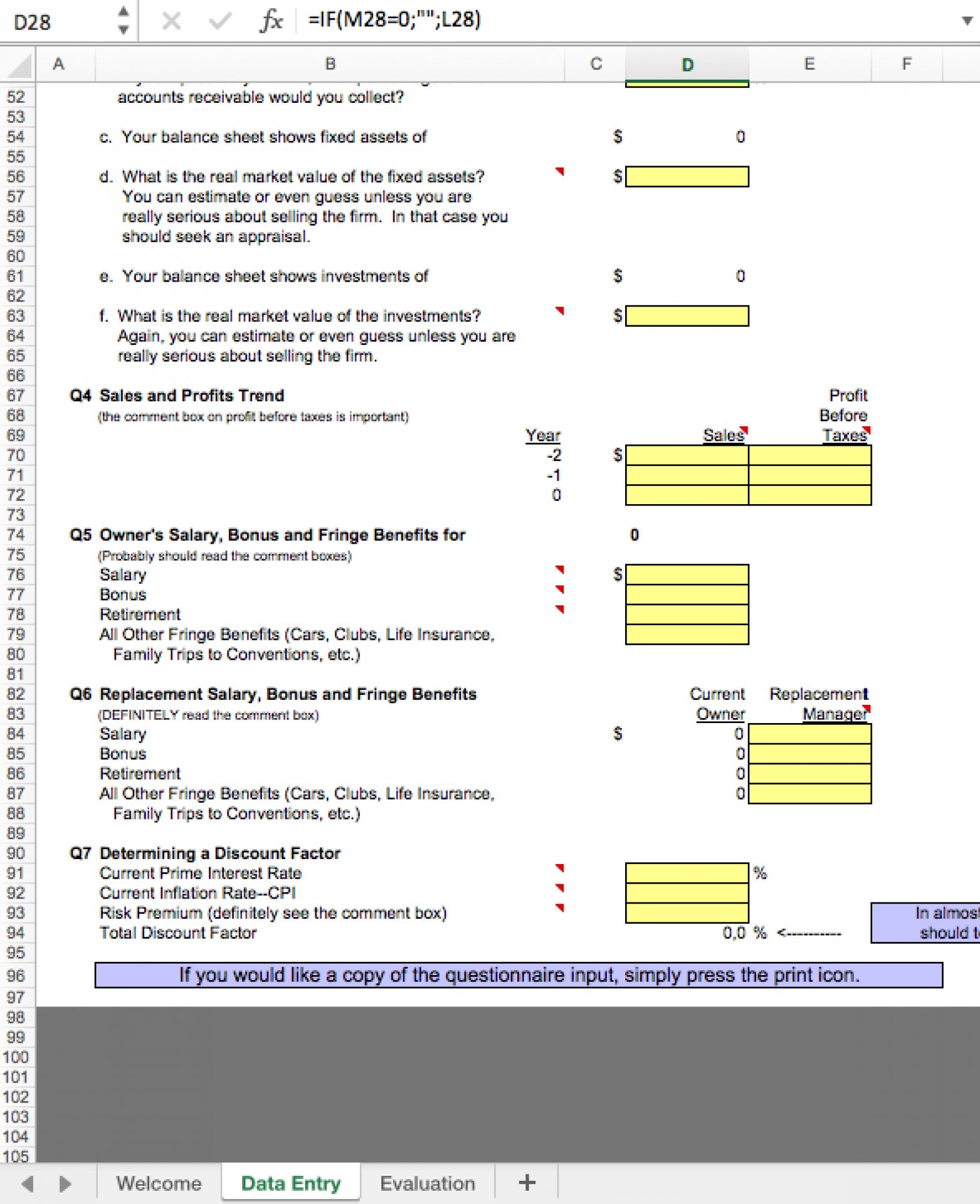

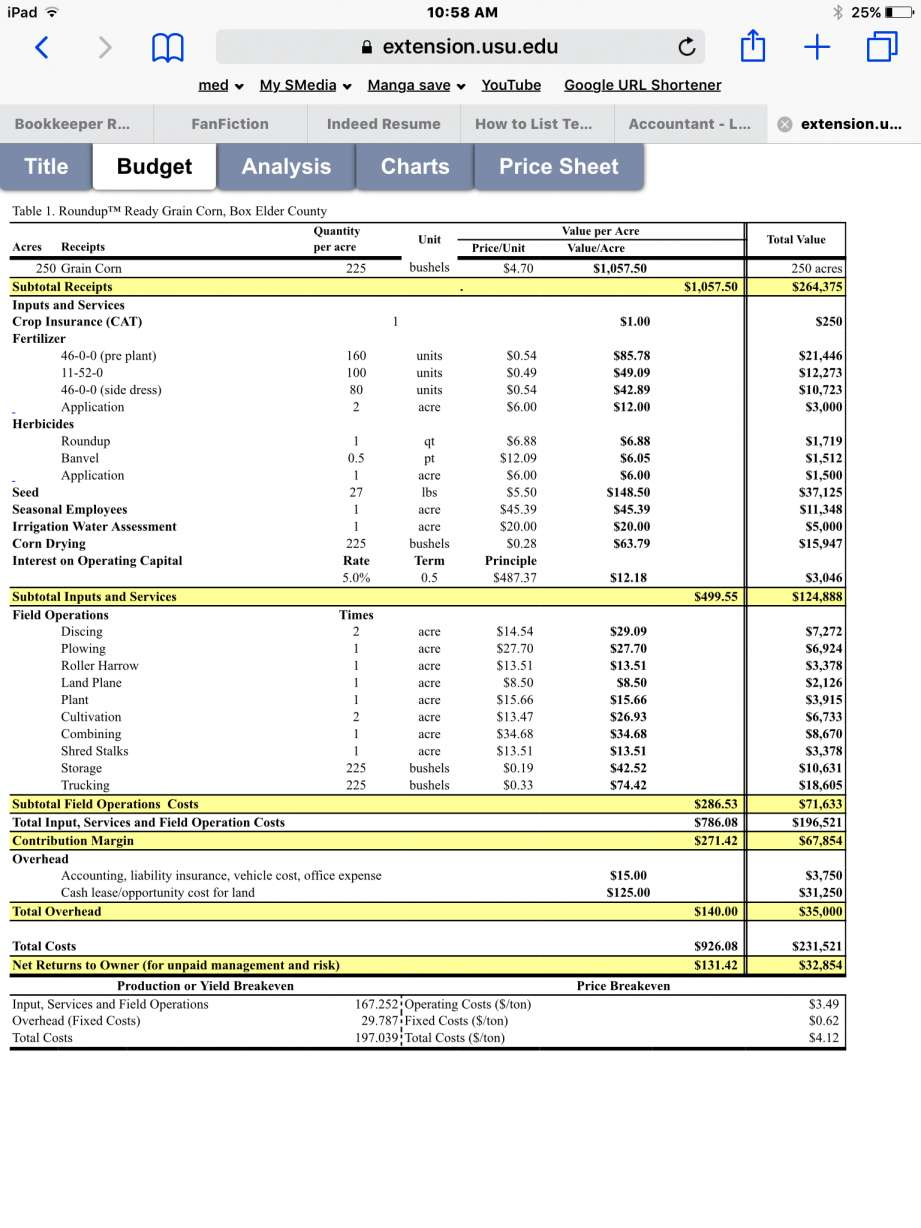

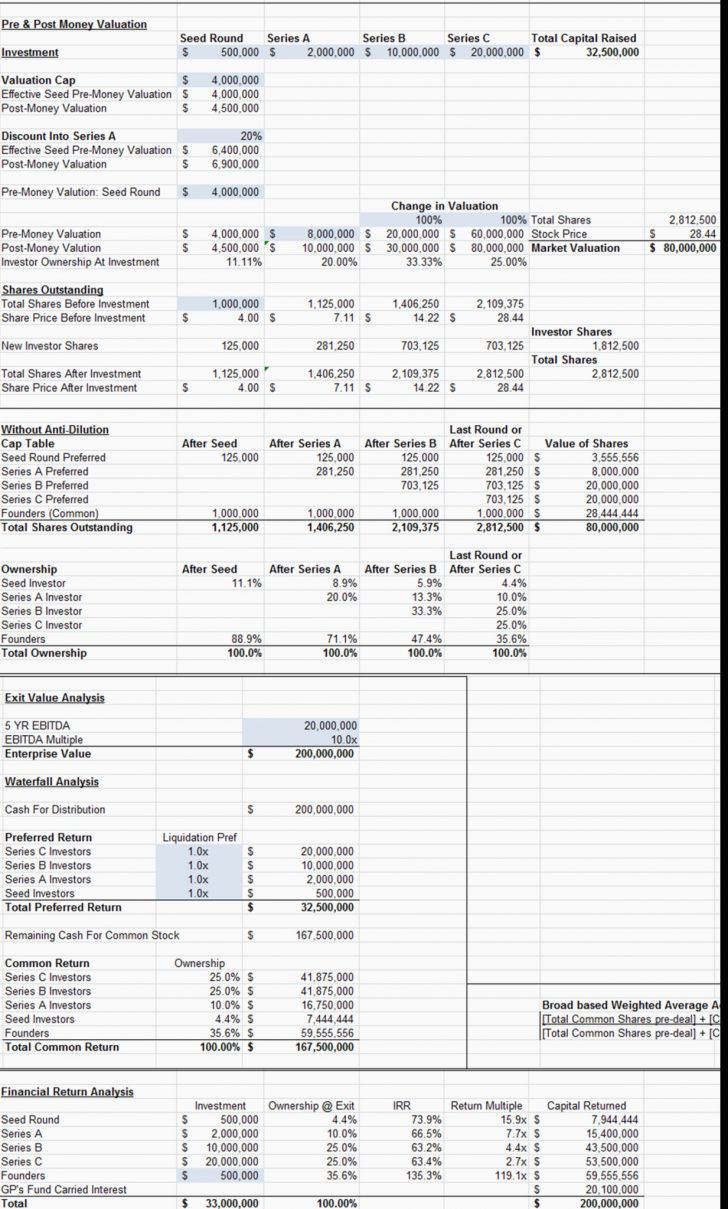

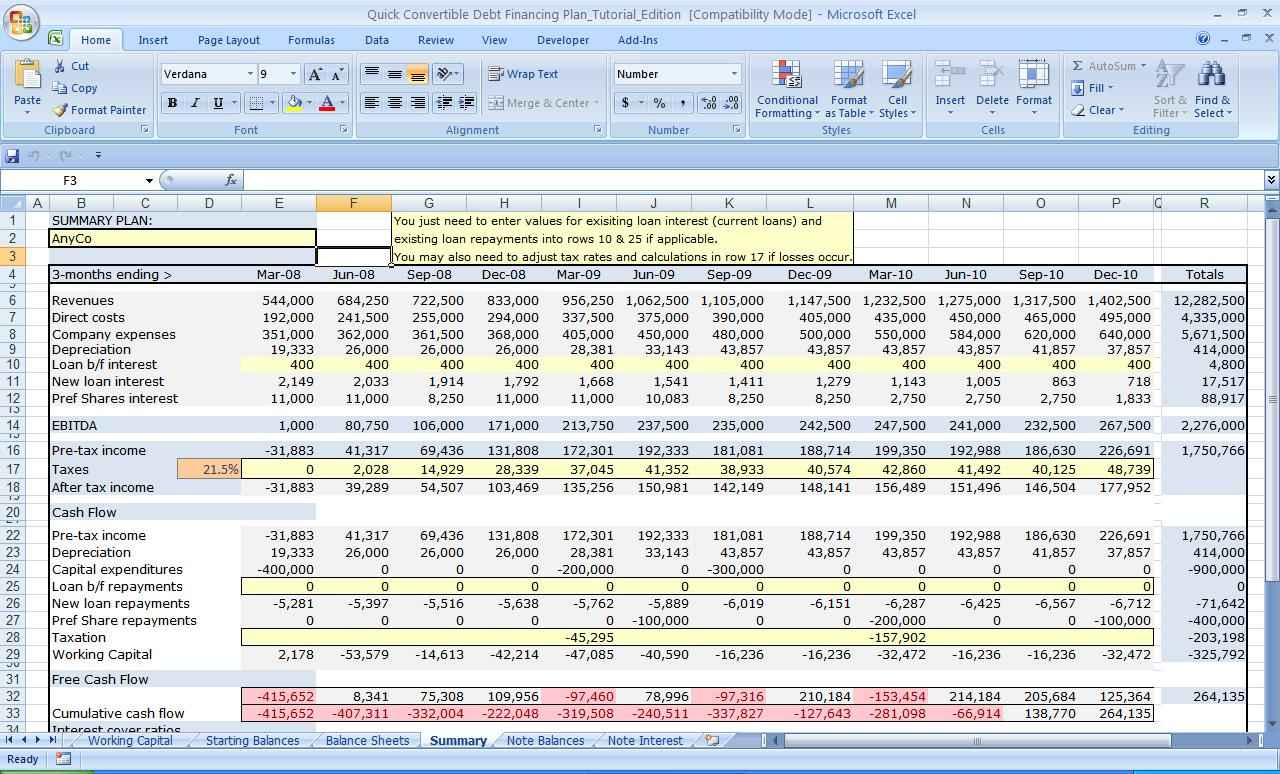

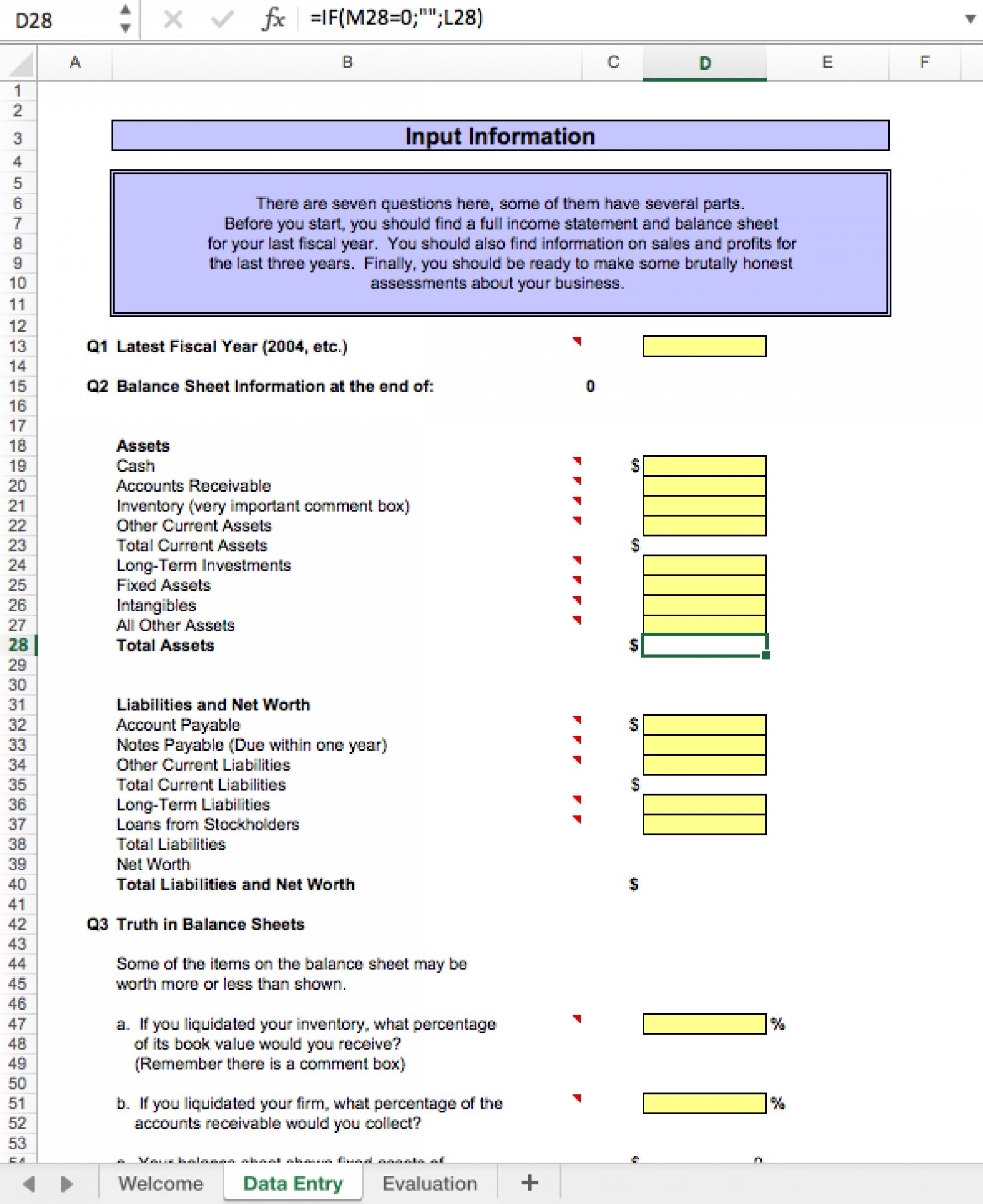

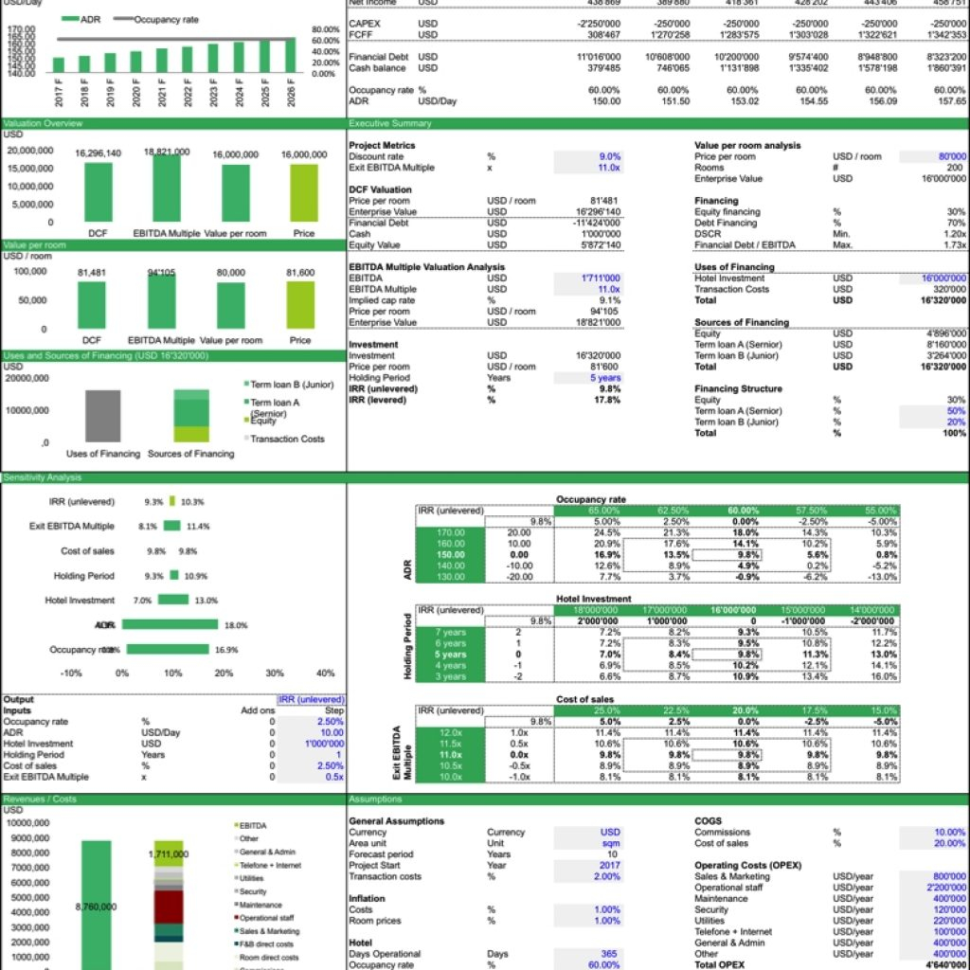

Company Valuation Excel Template Free - Enter your name and email in the form below and download the free template now!. Web we’ve compiled the most useful free discounted cash flow (dcf) templates, including customizable. Web download private company valuation example how to value a private company? Web free download this business valuation template design in excel, google sheets format. Web determining the value of your corporate is the starting point into built value. The three types of private companies and the main differences 6:22: Here’s methods in set up an simple. Web this value added excel template is a free tool provided by the corporate finance institute. Web (click here to download your excel template now.) this excel template uses a market approach by looking at. Ev/ebitda is a ratio that looks at a. Ev/ebitda is a ratio that looks at a. You can valuate your company without. Web download calculator quantic startup valuation calculator how to value a startup there are many ways to calculate. Web you can learn basic terminology of financial modeling and company valuation methods. Web free download this business valuation template design in excel, google sheets format. Enter your name and email in the form below and download the free template now! Examples of assets are stocks, options,. But the difference comes with. The three types of private companies and the main differences 6:22: Ev/ebitda is a ratio that looks at a. These factors can be evaluated either individually or in combination. Web download the free template. They typically indicate the intrinsic value per 1. Web the current value of anticipated future earnings from the business. The three types of private companies and the main differences 6:22: But the difference comes with. Web free download this business valuation template design in excel, google sheets format. Web identify a business' health and future based on profitability and other key metrics with our business valuation excel template. Web determining the value of your corporate is the starting point into built value. These factors can be evaluated either individually or. Examples of assets are stocks, options,. Web download calculator quantic startup valuation calculator how to value a startup there are many ways to calculate. Web download the free template. Web dcf model template. Web download the free template. These factors can be evaluated either individually or in combination. Enter your name and email in the form below and download the free template now! Web determining the value of your corporate is the starting point into built value. Web dcf model template. Web download the free template. Web june 20, 2023 valuation modeling refers to the forecasting and analysis using several different financial. Web the free cash flow valuation template includes following worksheets: Enter your name and email in the form below and download the free template now! These factors can be evaluated either individually or in combination. Web download calculator quantic startup valuation calculator how to. Web determining the value of your corporate is the starting point into built value. Examples of assets are stocks, options,. Here’s methods in set up an simple. Web valuation is the process of calculating the current worth of an asset or liability. They typically indicate the intrinsic value per 1. Enter your name and email in the form below and download the free template now! Web the free cash flow valuation template includes following worksheets: They typically indicate the intrinsic value per 1. Web one of the tools, which help model a company valuation is a valuation free excel template. Web download private company valuation example how to value a. Enter your name and email in the form below and download the free template now! Pl (income statement), bs (balance sheet), cf (cash. You can valuate your company without. Web download calculator quantic startup valuation calculator how to value a startup there are many ways to calculate. Web (click here to download your excel template now.) this excel template uses. Web the free cash flow valuation template includes following worksheets: These factors can be evaluated either individually or in combination. Enter your name and email in the form below and download the free template now!. But the difference comes with. Web (click here to download your excel template now.) this excel template uses a market approach by looking at. Web dcf model template. Web we’ve compiled the most useful free discounted cash flow (dcf) templates, including customizable. It’s the same way we do with public companies. Web the current value of anticipated future earnings from the business. Ev/ebitda is a ratio that looks at a. Web valuation is the process of calculating the current worth of an asset or liability. You can valuate your company without. Web the excel investment and business valuation template provides an easy and accurate solution for calculating the valuation of proposed. Web download private company valuation example how to value a private company? Web download the free template. Web one of the tools, which help model a company valuation is a valuation free excel template. Here’s methods in set up an simple. Web june 20, 2023 valuation modeling refers to the forecasting and analysis using several different financial. Web determining the value of your corporate is the starting point into built value. Web you can learn basic terminology of financial modeling and company valuation methods.Business Valuation Spreadsheet Excel Google Spreadshee business

Company Valuation Excel Spreadsheet —

Free Excel Business Valuation Spreadsheet —

Free Excel Business Valuation Spreadsheet —

Business Valuation Excel Template for Private Equity Eloquens

Free Excel Business Valuation Spreadsheet within Business Valuation

Free Excel Business Valuation Spreadsheet in Business Valuation

Business Valuation Spreadsheet Excel pertaining to Business Valuation

Business Valuation Excel Template for Private Equity Eloquens

Business Valuation Spreadsheet Template for Business Valuation

Related Post: