Employee Retention Credit Excel Template

Employee Retention Credit Excel Template - Provide the completed erc template and payroll reports from step 1 to your payroll service so that they can amend your q1 &. Ertc tax law in plain form. Enter a few data points to receive a free estimate. Web i’ll run through a detailed example using payroll and ppp loan assumptions to calculate a potential employee retention. Click file > make a copy at the top right hand of your screen. Confirm whether you had employees at some point in 2020 or 2021. Web beginning on january 1, 2021 and through june 30, 2021, eligible employers may claim a refundable tax credit against. Determine if you had a qualifying closure step 4: Look for advanced refund eligibility for erc worksheet assistance, contact erc today Web the credit is for 50% of eligible employee’s wages paid after march 12th, 2020 and before january 1st, 2021. Calculate the erc for your business step 7: Web key provisions of the erc (cont’d.) key provisions of the erc (cont’d.) what are the next steps considering. Web get started with the ey employee retention credit calculator. Determine if you had a qualifying closure step 4: Confirm whether you had employees at some point in 2020 or 2021. The following tools for calculating erc were. Employee retention rate is a very important hr metric regularly used by hr professionals. Ertc tax law in plain form. Web for calculating the employee retention credit, you should follow the below steps: Click file > make a copy at the top right hand of your screen. Calculate the erc for your business step 7: Web for calculating the employee retention credit, you should follow the below steps: Following 7 kpis are automatically. Determine business status step 5: The following tools for calculating erc were. Enter a few data points to receive a free estimate. Web employee retention credit spreadsheet brown schultz sheridan & fritz 63 subscribers subscribe 19 share 7.6k. Calculate the erc for your business step 7: Web the employee retention credit (erc) is a refundable tax credit for businesses that continued to pay employees while either. Web get started with the ey. If you have not employed any workers in. Calculate the erc for your business step 7: Web get started with the ey employee retention credit calculator. Web employee retention credit spreadsheet brown schultz sheridan & fritz 63 subscribers subscribe 19 share 7.6k. Web i’ll run through a detailed example using payroll and ppp loan assumptions to calculate a potential employee. Web the credit is for 50% of eligible employee’s wages paid after march 12th, 2020 and before january 1st, 2021. The following tools for calculating erc were. Web i’ll run through a detailed example using payroll and ppp loan assumptions to calculate a potential employee retention. Web get started with the ey employee retention credit calculator. Determine business status step. Assess your qualified wages for each year step 6: Click file > make a copy at the top right hand of your screen. Web the credit is for 50% of eligible employee’s wages paid after march 12th, 2020 and before january 1st, 2021. Web for calculating the employee retention credit, you should follow the below steps: Web practitioners are sure. Web get started with the ey employee retention credit calculator. Ertc tax law in plain form. Assess your qualified wages for each year step 6: Web the credit is for 50% of eligible employee’s wages paid after march 12th, 2020 and before january 1st, 2021. Web i’ll run through a detailed example using payroll and ppp loan assumptions to calculate. Ertc tax law in plain form. Employee retention dashboard 7 kpis. Following 7 kpis are automatically. Web key provisions of the erc (cont’d.) key provisions of the erc (cont’d.) what are the next steps considering. The following tools for calculating erc were. Look for advanced refund eligibility for erc worksheet assistance, contact erc today Ertc tax law in plain form. The following tools for calculating erc were. Determine business status step 5: Web the excel spreadsheet shows the potential employee retention credit by employee for each quarter. The following tools for calculating erc were. Web i’ll run through a detailed example using payroll and ppp loan assumptions to calculate a potential employee retention. Web key provisions of the erc (cont’d.) key provisions of the erc (cont’d.) what are the next steps considering. Employee retention dashboard 7 kpis. Determine if you had a qualifying closure step 4: Web practitioners are sure to see a lot of employee retention credit (erc) issues. Web employee retention credit spreadsheet brown schultz sheridan & fritz 63 subscribers subscribe 19 share 7.6k. Confirm whether you had employees at some point in 2020 or 2021. Look for advanced refund eligibility for erc worksheet assistance, contact erc today Assess your qualified wages for each year step 6: Web for calculating the employee retention credit, you should follow the below steps: Web the employee retention credit (erc) is a refundable tax credit for businesses that continued to pay employees while either. If you have not employed any workers in. Determine business status step 5: Following 7 kpis are automatically. Web get started with the ey employee retention credit calculator. Web beginning on january 1, 2021 and through june 30, 2021, eligible employers may claim a refundable tax credit against. Web the second provides a refundable payroll credit, usually called the employee retention tax credit (ertc). Web the excel spreadsheet shows the potential employee retention credit by employee for each quarter. Ertc tax law in plain form.The The employee retention credit is a significant tax CNBC Statements

Download Employee Retention Rate Calculator Excel Template

Employee Retention Credit Worksheet 1

Employee Retention Credit (ERC) Calculator Gusto

Qualifying for Employee Retention Credit (ERC) Gusto

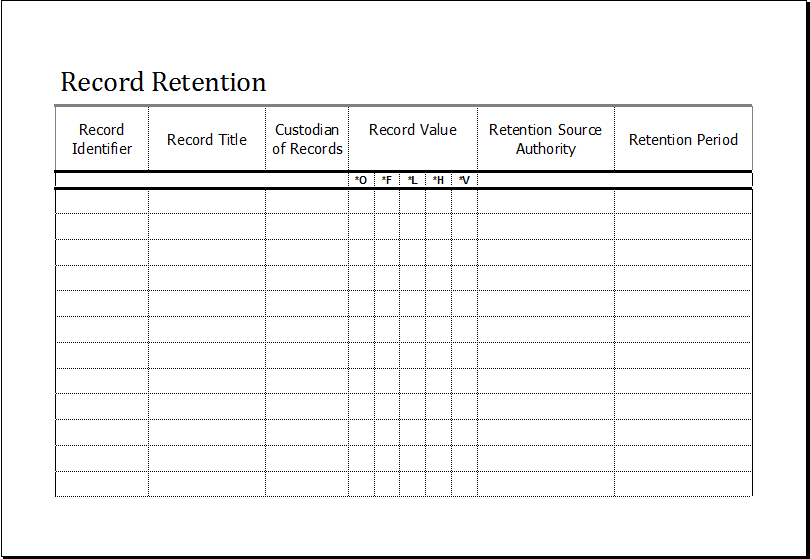

Record Retention Schedule Template for EXCEL Excel Templates

Employee Retention Credit (ERC) Calculator Gusto

Employee retention tax credit calculation ShanaPatrick

Retention Dashboard Excel Template Step by Step User Guide

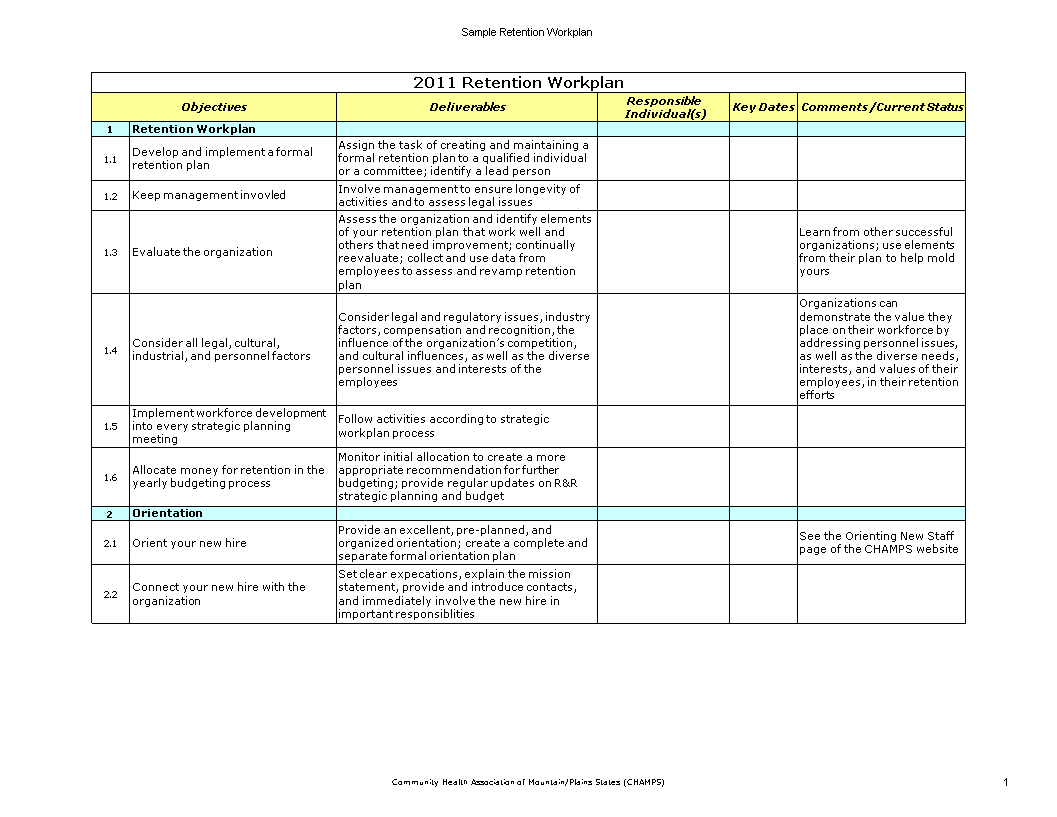

Sample Retention Workplan Excel Templates at

Related Post: