Erc Credit Calculation Template

Erc Credit Calculation Template - The original erc gave employers a maximum credit of up to $10,000 per employee retained from. A simple, guided tool to help businesses calculate their potential erc. Please read the following notes on the erc spreadsheet: Web the erc under the cares act gives employers a payroll tax credit for certain wages and health plan expenses. Each cwa client will need to determine if and at what level they. Web under the coronavirus aid, relief, and economic security act (cares act), the employee retention credit (erc). Web the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help. Web for 2021, employers can take a 70% credit for each of their qualified employees per quarter. Our erc calculator determines how much erc you are eligible to receive per quarter. Understand which quarters qualify step 2: Sign up for the ey erc calculator to. Web we have created an employee retention credit calculator 2021 with predefined formulas and functions. Web brad johnson : Web under the coronavirus aid, relief, and economic security act (cares act), the employee retention credit (erc). Web the ey erc calculator: Web the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help. The original erc gave employers a maximum credit of up to $10,000 per employee retained from. Our erc calculator determines how much erc you are eligible to receive per quarter. Web the employee retention credit (erc) is a refundable tax credit. Web employee retention credit worksheet calculation step 1: Web use our tax credit estimator to calculate your potential erc amount. Confirm your eligibility the first eligibility situation for the employer. Web under the coronavirus aid, relief, and economic security act (cares act), the employee retention credit (erc). Please read the following notes on the erc spreadsheet: Web download this memo template to assist in the documentation needed for businesses or clients that claim the. Web under the coronavirus aid, relief, and economic security act (cares act), the employee retention credit (erc). Web here’s how to calculate the erc tax credit: How to calculate the employee retention credit. Web the erc under the cares act gives employers. Web brad johnson : Web employee retention credit worksheet calculation step 1: Web here’s how to calculate the erc tax credit: Under the regular erc rules, you can claim a credit for 50% of the first. How to calculate the employee retention credit. Web the employee retention credit (erc) is a refundable tax credit for businesses that continued to pay employees while either. Web brad johnson : Web the erc under the cares act gives employers a payroll tax credit for certain wages and health plan expenses. 4.2.2021 taxes you can earn a tax credit of up to $33,000 per employee in wages. The estimate is based on the data. Web the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help. Web here’s how to calculate the erc tax credit: Web enter some basic information to receive an estimate of your erc for the applicable year. Web brad johnson : Web we have created an employee retention credit calculator 2021 with predefined formulas and functions. The original erc gave employers a maximum credit of up to $10,000 per employee retained from. Please read the following notes on the erc spreadsheet: 4.2.2021 taxes you can earn a tax credit of up to $33,000 per employee in wages paid under the. Web. Understand which quarters qualify step 2: Web under the coronavirus aid, relief, and economic security act (cares act), the employee retention credit (erc). The estimate is based on the data. Under the regular erc rules, you can claim a credit for 50% of the first. Web here’s how to calculate the erc tax credit: Web for 2021, employers can take a 70% credit for each of their qualified employees per quarter. Web use our tax credit estimator to calculate your potential erc amount. Understand which quarters qualify step 2: Web we have created an employee retention credit calculator 2021 with predefined formulas and functions. This template helps calculate erc for. Under the regular erc rules, you can claim a credit for 50% of the first. Web we have created an employee retention credit calculator 2021 with predefined formulas and functions. Web brad johnson : Web download this memo template to assist in the documentation needed for businesses or clients that claim the. Web for 2021, employers can take a 70% credit for each of their qualified employees per quarter. The estimate is based on the data. Each cwa client will need to determine if and at what level they. The original erc gave employers a maximum credit of up to $10,000 per employee retained from. Web process & worksheet for maximizing ppp1 and erc please note: Web the employee retention credit (erc) is a refundable tax credit for businesses that continued to pay employees while either. Web the ey erc calculator: Web here’s how to calculate the erc tax credit: Web use our tax credit estimator to calculate your potential erc amount. Web these templates will assist you in determining your specific qualification and the potential credit to your business. Web employee retention credit worksheet calculation step 1: Web how to calculate the employee retention credit. Web under the coronavirus aid, relief, and economic security act (cares act), the employee retention credit (erc). This template helps calculate erc for. 4.2.2021 taxes you can earn a tax credit of up to $33,000 per employee in wages paid under the. Web enter some basic information to receive an estimate of your erc for the applicable year.Ertc Worksheet Excel

ARCIC Payment Examples and Revised 2019 Payment Calculator AgFax

Employee Retention Credit (ERC) Calculator Gusto

Qualifying for Employee Retention Credit (ERC) Gusto

Ertc Worksheet Excel

Employee Retention Credit (ERC) Calculator Gusto

employee retention credit calculation spreadsheet 2021

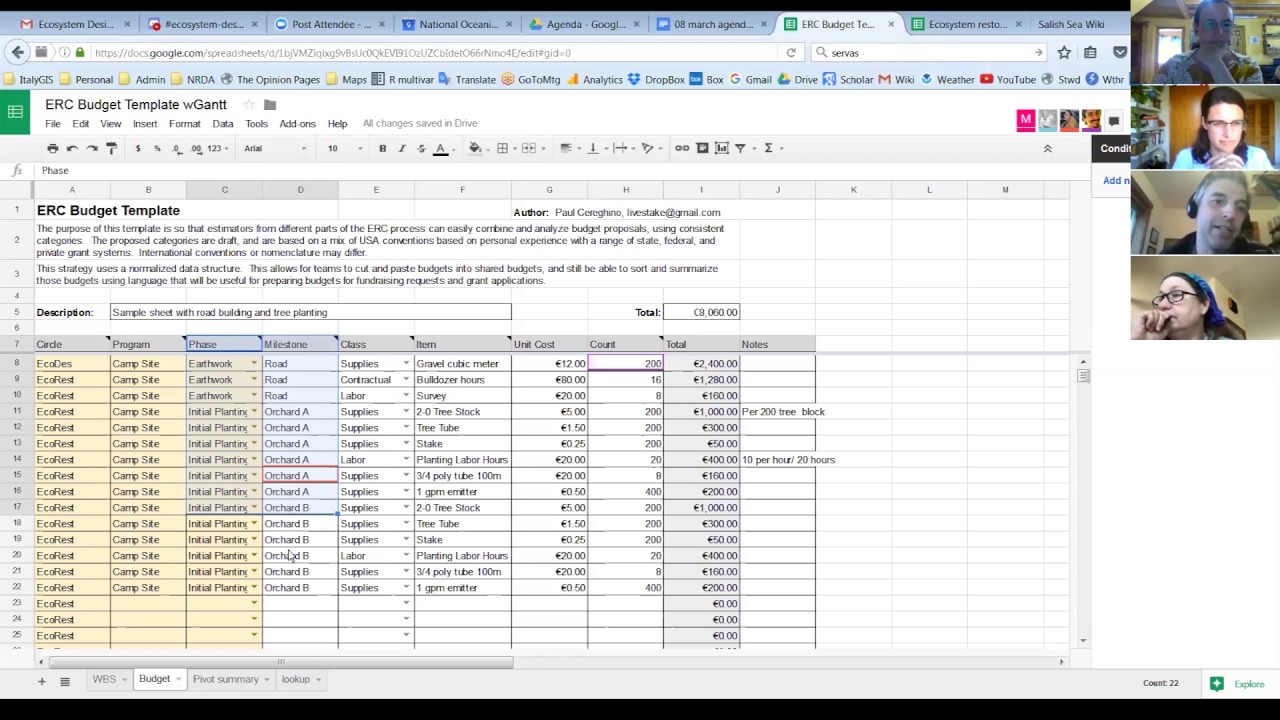

ERC Budget Template Proposal YouTube

Qualifying for Employee Retention Credit (ERC) Gusto

Ertc Worksheet Excel

Related Post: