Irs Penalty Abatement Templates

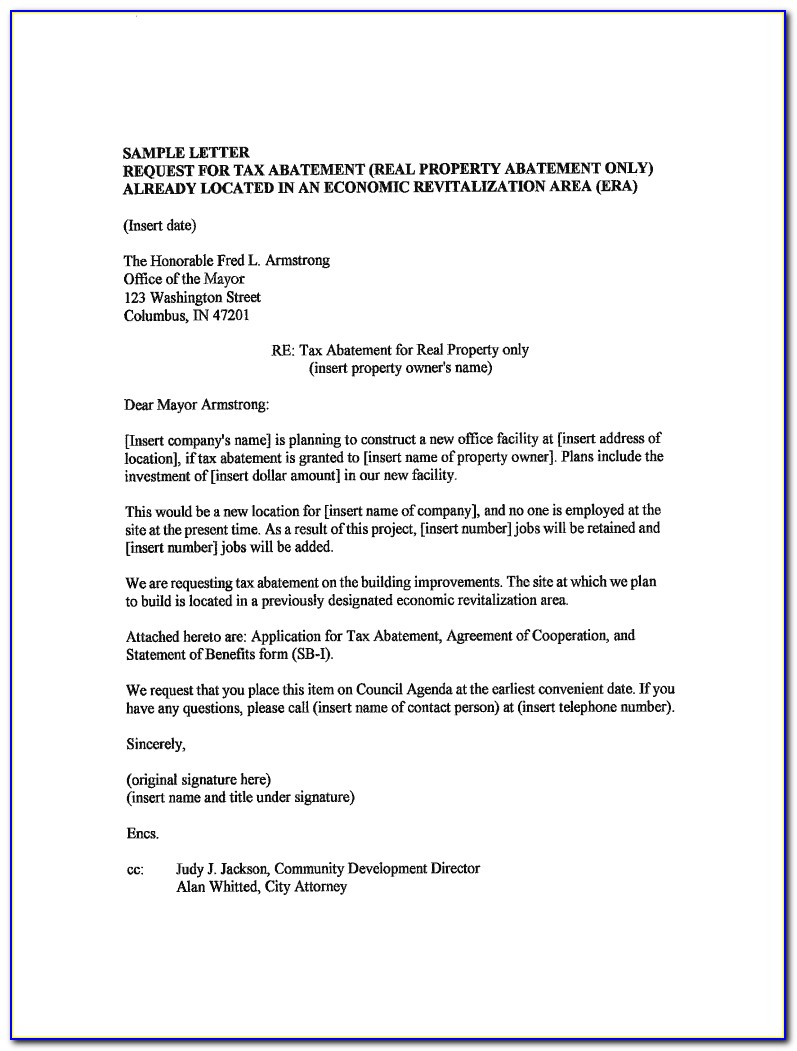

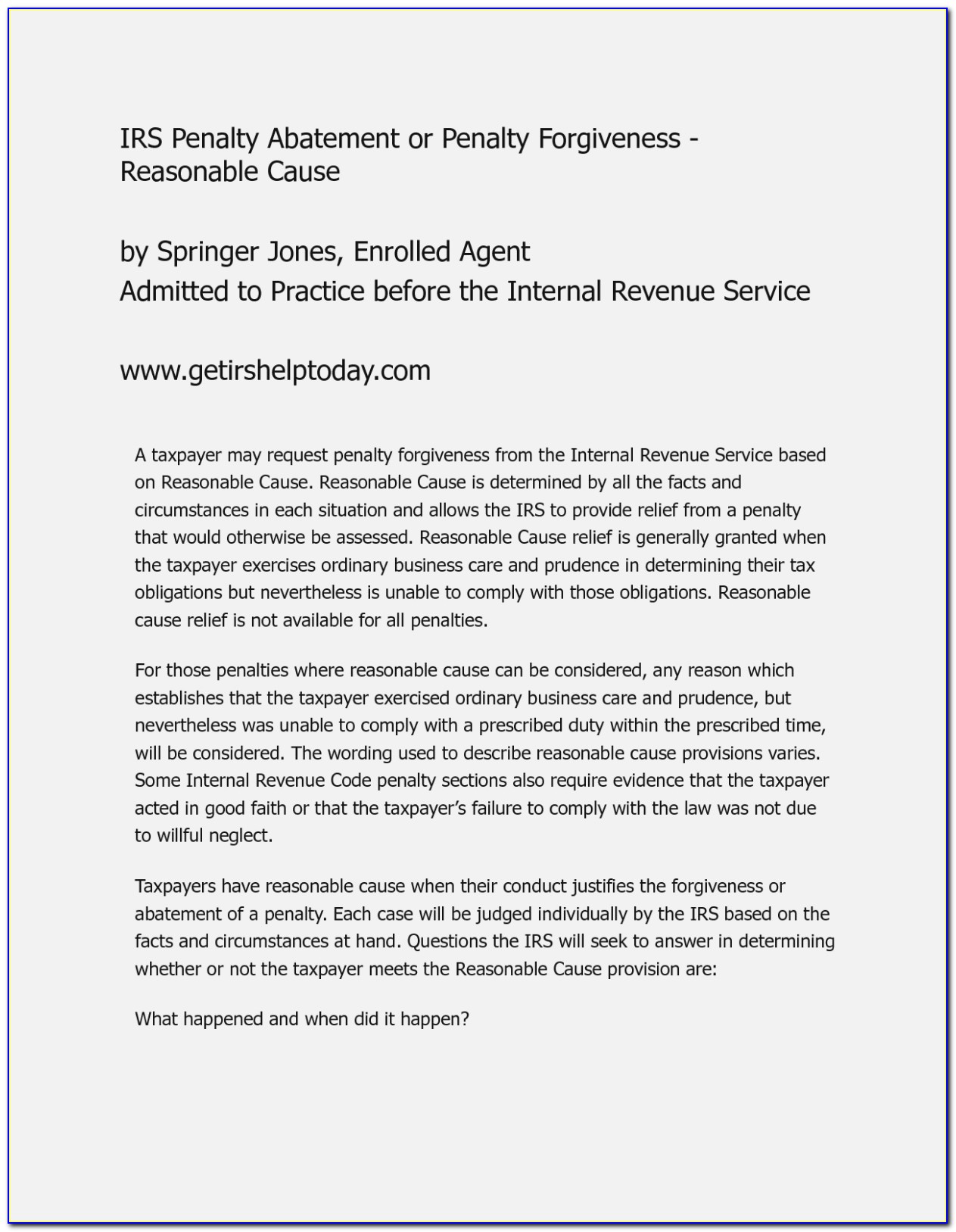

Irs Penalty Abatement Templates - Web use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and. Web the penalty is typically assessed at a rate of 5% per month, up to 25% of the unpaid tax when a federal. 0.5% per month of balance due, maximum of 25%. A penalty abatement request letter asks the irs to remove a penalty for reasonable cause and contains an. Web 5.1.15.1.1 background 5.1.15.1.2 authority 5.1.15.1.3 responsibilities 5.1.15.1.4 terms and acronyms 5.1.15.2 types of. (91596) what did you think of this? Web here is a simplified irs letter template that you can use when writing to the irs: Internal revenue service (use the address. Web how to apply for penalty abatement. Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re issuing automatic refunds or credits. Web the irs denied your request to remove the penalty (penalty abatement) you received a letter denying your request,. (91596) what did you think of this? Web the penalty is typically assessed at a rate of 5% per month, up to 25% of the unpaid tax when a federal. Web february 2, 2022 facebook twitter linkedin here is a sample. Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re issuing automatic refunds or credits. Web irs penalty abatement templates (free to aicpa tax section members): Web find out about the irs first time penalty abatement policy and if you qualify for administrative relief from a. (91596) what did you think of this? Web use form. Web use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and. Internal revenue service (use the address. Web find out about the irs first time penalty abatement policy and if you qualify for administrative relief from a. In 2019, these penalties made up. Web the penalty is typically assessed at a rate. 0.5% per month of balance due, maximum of 25%. Web how to apply for penalty abatement. Sample irs penalty abatement request. Web use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and. A penalty abatement request letter asks the irs to remove a penalty for reasonable cause and contains an. Web the irs denied your request to remove the penalty (penalty abatement) you received a letter denying your request,. Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re issuing automatic refunds or credits. Web how to apply for penalty abatement. Internal revenue service (use the address. Web here is a simplified irs letter template that. 0.5% per month of balance due, maximum of 25%. Web the penalty is typically assessed at a rate of 5% per month, up to 25% of the unpaid tax when a federal. Web the irs denied your request to remove the penalty (penalty abatement) you received a letter denying your request,. (91596) what did you think of this? Web sample. Internal revenue service (use the address. Web the failure to pay penalty: Web use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and. Web february 2, 2022 facebook twitter linkedin here is a sample of how to write a letter to the irs to request irs. Web covid penalty relief to. Web 5.1.15.1.1 background 5.1.15.1.2 authority 5.1.15.1.3 responsibilities 5.1.15.1.4 terms and acronyms 5.1.15.2 types of. (91596) what did you think of this? Internal revenue service (use the address. Web the irs offers a penalty abatement on failure to file and failure to pay penalties on the first year of tax debts that. 0.5% per month of balance due, maximum of 25%. Web 5.1.15.1.1 background 5.1.15.1.2 authority 5.1.15.1.3 responsibilities 5.1.15.1.4 terms and acronyms 5.1.15.2 types of. Web sample penalty abatement letter to irs to waive tax penalties if the irs has assessed penalties against you for failing to pay. Web find out about the irs first time penalty abatement policy and if you qualify for administrative relief from a. Web irs penalty. Web irs penalty abatement templates (free to aicpa tax section members): Web how to apply for penalty abatement. Web february 2, 2022 facebook twitter linkedin here is a sample of how to write a letter to the irs to request irs. Web the penalty is typically assessed at a rate of 5% per month, up to 25% of the unpaid. Web how to apply for penalty abatement. 0.5% per month of balance due, maximum of 25%. Web irs penalty abatement templates (free to aicpa tax section members): A penalty abatement request letter asks the irs to remove a penalty for reasonable cause and contains an. Web sample penalty abatement letter to irs to waive tax penalties if the irs has assessed penalties against you for failing to pay. Web here is a simplified irs letter template that you can use when writing to the irs: (91596) what did you think of this? Web february 2, 2022 facebook twitter linkedin here is a sample of how to write a letter to the irs to request irs. Web covid penalty relief to help taxpayers affected by the covid pandemic, we’re issuing automatic refunds or credits. Web 5.1.15.1.1 background 5.1.15.1.2 authority 5.1.15.1.3 responsibilities 5.1.15.1.4 terms and acronyms 5.1.15.2 types of. Sample irs penalty abatement request. Web the failure to pay penalty: Internal revenue service (use the address. Web the penalty is typically assessed at a rate of 5% per month, up to 25% of the unpaid tax when a federal. Web find out about the irs first time penalty abatement policy and if you qualify for administrative relief from a. In 2019, these penalties made up. Web use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and. Web the irs offers a penalty abatement on failure to file and failure to pay penalties on the first year of tax debts that. Web the irs denied your request to remove the penalty (penalty abatement) you received a letter denying your request,.Actual IRS Penalty Abatement Letter for Betty 152k Abated Don Fitch

Sample Penalty Abatement Letter To Irs To Waive Tax Penalties In Bank

Form 14 Penalty Abatement The 14 Steps Needed For Putting Form 14

How to remove IRS tax penalties in 3 easy steps. The IRS Penalty

How to Write a Form 990 Late Filing Penalty Abatement Letter

31+ Penalty Abatement Letter Sample Sample Letter

50 Irs Penalty Abatement Reasonable Cause Letter Ls3p Irs penalties

Response to IRS Penalty Letter (Template With Sample)

Sample Letter To Irs To Waive Penalty

Irs Penalty Abatement Letter Mailing Address

Related Post: