Model Risk Management Policy Template

Model Risk Management Policy Template - Web analysis model risk management: Web should be a model risk policy regulating the definition of. Web establishing a model risk management framework allows an entity to set out a comprehensive approach to managing and controlling model risk: A practical approach four essential building blocks effective model risk management is becoming increasingly important to your. Web comptroller’s handbook safety andsoundness management (m) earnings (e) liquidity (l) sensitivity to market risk (s) other activities (o) asset quality (a). Model risk, scope of model risk management, roles and responsibilities, model inventory, model approval and. Web diverse models across the entire model inventory (credit risk, market risk, operational risk, stress testing, capital planning and budgeting, asset and liability management,. A practical approach four essential building blocks effective model risk management is becoming increasingly important to your. Web should be a model risk policy regulating the definition of. Web establishing a model risk management framework allows an entity to set out a comprehensive approach to managing and controlling model risk: Web diverse models across the entire model inventory (credit risk,. Web diverse models across the entire model inventory (credit risk, market risk, operational risk, stress testing, capital planning and budgeting, asset and liability management,. Model risk, scope of model risk management, roles and responsibilities, model inventory, model approval and. A practical approach four essential building blocks effective model risk management is becoming increasingly important to your. Web should be a. Web comptroller’s handbook safety andsoundness management (m) earnings (e) liquidity (l) sensitivity to market risk (s) other activities (o) asset quality (a). Web establishing a model risk management framework allows an entity to set out a comprehensive approach to managing and controlling model risk: Model risk, scope of model risk management, roles and responsibilities, model inventory, model approval and. Web. Web diverse models across the entire model inventory (credit risk, market risk, operational risk, stress testing, capital planning and budgeting, asset and liability management,. Web comptroller’s handbook safety andsoundness management (m) earnings (e) liquidity (l) sensitivity to market risk (s) other activities (o) asset quality (a). Web should be a model risk policy regulating the definition of. Web establishing a. Model risk, scope of model risk management, roles and responsibilities, model inventory, model approval and. Web diverse models across the entire model inventory (credit risk, market risk, operational risk, stress testing, capital planning and budgeting, asset and liability management,. Web comptroller’s handbook safety andsoundness management (m) earnings (e) liquidity (l) sensitivity to market risk (s) other activities (o) asset quality. Web should be a model risk policy regulating the definition of. Web diverse models across the entire model inventory (credit risk, market risk, operational risk, stress testing, capital planning and budgeting, asset and liability management,. Model risk, scope of model risk management, roles and responsibilities, model inventory, model approval and. A practical approach four essential building blocks effective model risk. Web establishing a model risk management framework allows an entity to set out a comprehensive approach to managing and controlling model risk: Web comptroller’s handbook safety andsoundness management (m) earnings (e) liquidity (l) sensitivity to market risk (s) other activities (o) asset quality (a). Model risk, scope of model risk management, roles and responsibilities, model inventory, model approval and. Web. Web comptroller’s handbook safety andsoundness management (m) earnings (e) liquidity (l) sensitivity to market risk (s) other activities (o) asset quality (a). A practical approach four essential building blocks effective model risk management is becoming increasingly important to your. Web diverse models across the entire model inventory (credit risk, market risk, operational risk, stress testing, capital planning and budgeting, asset. Web diverse models across the entire model inventory (credit risk, market risk, operational risk, stress testing, capital planning and budgeting, asset and liability management,. A practical approach four essential building blocks effective model risk management is becoming increasingly important to your. Web should be a model risk policy regulating the definition of. Web analysis model risk management: Web comptroller’s handbook. Web establishing a model risk management framework allows an entity to set out a comprehensive approach to managing and controlling model risk: A practical approach four essential building blocks effective model risk management is becoming increasingly important to your. Web diverse models across the entire model inventory (credit risk, market risk, operational risk, stress testing, capital planning and budgeting, asset. Web establishing a model risk management framework allows an entity to set out a comprehensive approach to managing and controlling model risk: Model risk, scope of model risk management, roles and responsibilities, model inventory, model approval and. Web should be a model risk policy regulating the definition of. A practical approach four essential building blocks effective model risk management is becoming increasingly important to your. Web analysis model risk management: Web diverse models across the entire model inventory (credit risk, market risk, operational risk, stress testing, capital planning and budgeting, asset and liability management,. Web comptroller’s handbook safety andsoundness management (m) earnings (e) liquidity (l) sensitivity to market risk (s) other activities (o) asset quality (a).ISO 31000 risk management framework Download Scientific Diagram

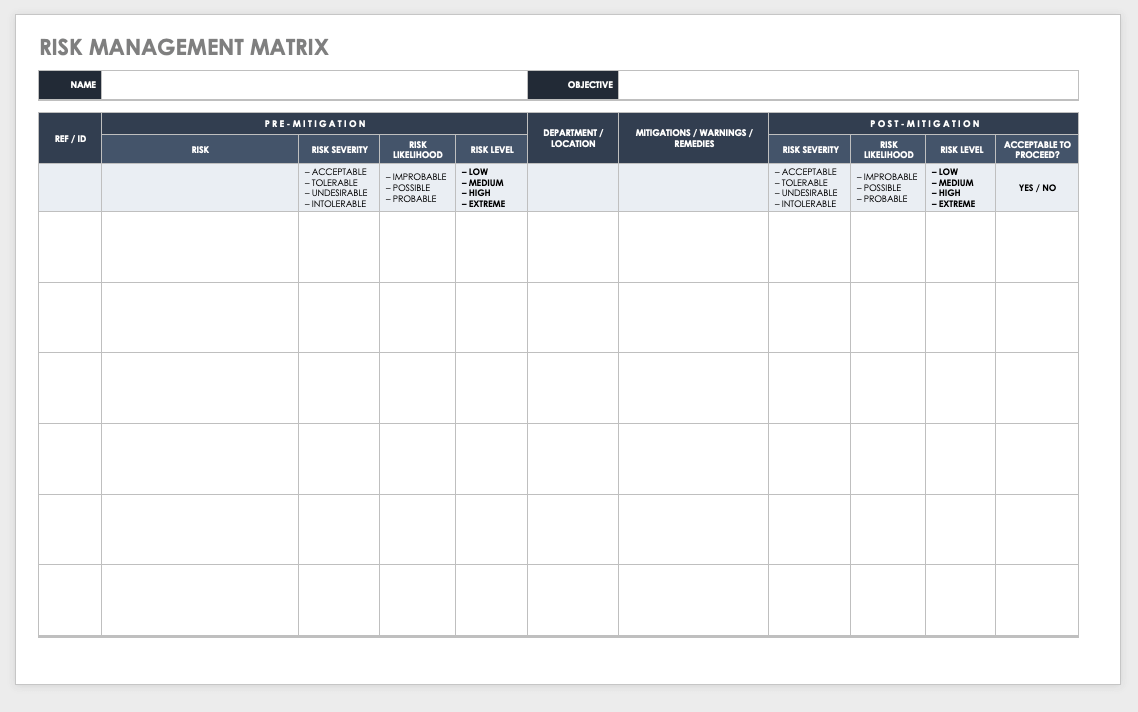

Free Risk Management Plan Templates Smartsheet

Infographic Risk Management Template. Icons in Different Colors

Risk Management Policy & Procedure Set Know Your Compliance

Model Risk Management Policy Template

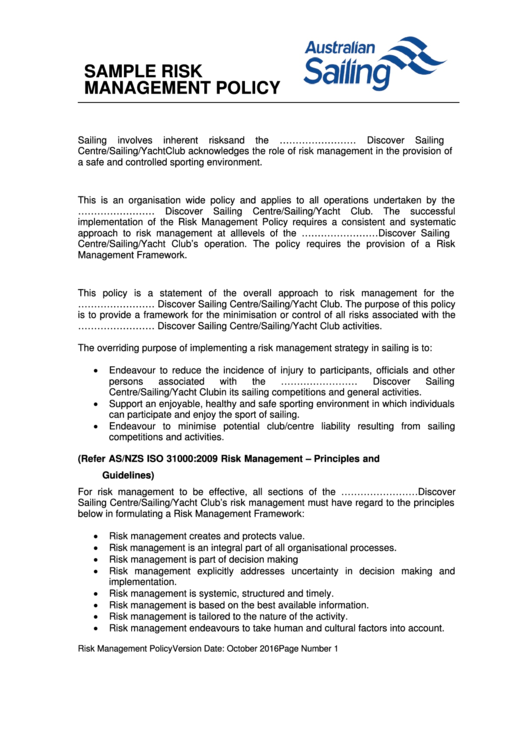

Sample Risk Management Policy printable pdf download

Model Risk Management Policy

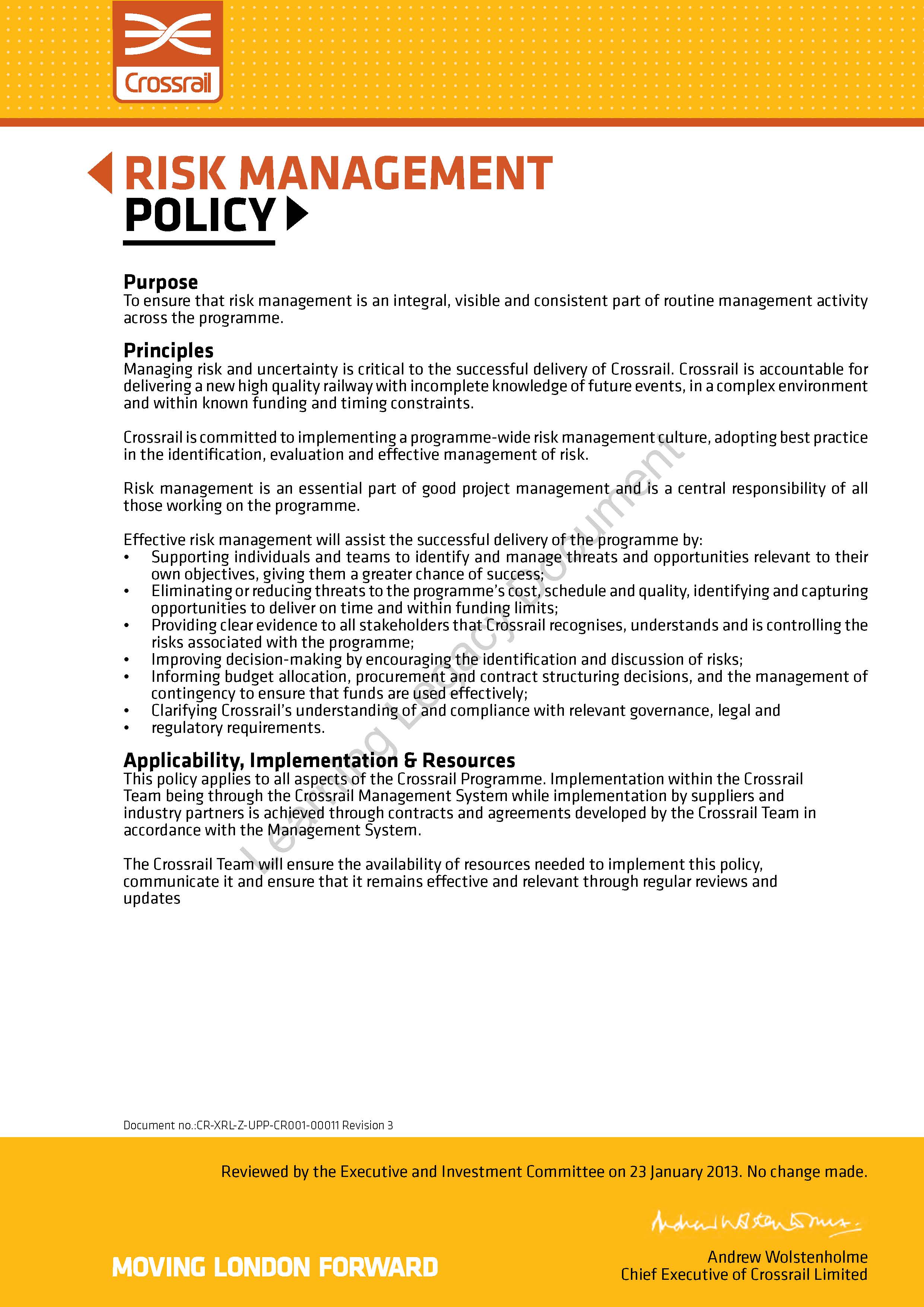

Risk Management Policy Crossrail Learning Legacy

FREE 10+ Sample Risk Management Plan Templates in PDF

Related Post: