Response Letter To Irs Template

Response Letter To Irs Template - • you are due a larger refund; Web do to respond. Provide specific reasons why you believe the irs is mistaken, and reference your. An explanation letter or a letter of explanation is any letter used to. Web the irs is one in that most feared government agencies. Web draft a response letter to the irs, outlining any claims that you dispute. In addition to the documents the irs has requested, you should send a letter. Web if the notice or letter requires a response by a specific date, taxpayers should reply in a timely manner to:. Web internal revenue service 310 lowell st. Generally, the irs sends a letter if: Notice cp2000 (2014) aur control number to whom this concerns, i. Web internal revenue service 310 lowell st. Web do to respond. Or • the irs is. Web full name and spouse's full name if applicable ssn here (if you and your spouse filed jointly, use the ssn that appears first. An explanation letter or a letter of explanation is any letter used to. Web draft a response letter to the irs, outlining any claims that you dispute. Web the irs is one in that most feared government agencies. Web respond if your notice or letter requires a response by a specific date, there are two main reasons you’ll want to.. Web how to use this document. Web the irs is one in that most feared government agencies. Web irs penalty response letter full name of the person or business requesting the review of an irs penalty, known going forward as. Web respond if your notice or letter requires a response by a specific date, there are two main reasons you’ll. Web discover how quickly and painlessly you can write those important letters using the collection of templates included in the. • you are due a larger refund; Web this letter is issued by the appeals office of the irs acknowledging they received your withdrawal request for a. Web do to respond. Web if a taxpayer doesn't agree with the irs,. Web if the notice or letter requires a response by a specific date, taxpayers should reply in a timely manner to:. Web the irs is one in that most feared government agencies. This document includes all of the information necessary for a taxpayer to request that. An explanation letter or a letter of explanation is any letter used to. If. First, what is or is not an equitable. Web if a taxpayer doesn't agree with the irs, they should mail a letter explaining why they dispute the notice. If your notice or letter requires a response by a specific date (typically it is 30 days), there are two main. Web the irs is one in that most feared government agencies.. • you owe additional tax; Web internal revenue service 310 lowell st. Notice cp2000 (2014) aur control number to whom this concerns, i. Most irs letters have two options: Web respond if your notice or letter requires a response by a specific date, there are two main reasons you’ll want to. The response addresses two issues. Web final thoughts what is an explanation letter? Web irs response letter template form: Most irs letters have two options: Or • the irs is. • you are due a larger refund; An explanation letter or a letter of explanation is any letter used to. Or • the irs is. If your notice or letter requires a response by a specific date (typically it is 30 days), there are two main. However, thee have nothing to fear available you need to. • you owe additional tax; Web an irs penalty response letter are a documentation used to file a request using the irs that a penalty levied against a. Web respond if your notice or letter requires a response by a specific date, there are two main reasons you’ll want to. Provide specific reasons why you believe the irs is mistaken,. Web final thoughts what is an explanation letter? Web draft a response letter to the irs, outlining any claims that you dispute. Web an irs penalty response letter are a documentation used to file a request using the irs that a penalty levied against a. Provide specific reasons why you believe the irs is mistaken, and reference your. This document includes all of the information necessary for a taxpayer to request that. Most irs letters have two options: Generally, the irs sends a letter if: Web if a taxpayer doesn't agree with the irs, they should mail a letter explaining why they dispute the notice. Web don’t panic if you receive one of the millions of notices and letters the irs sends to taxpayers every year. Web written explanation sample letter to the irs. Web respond if your notice or letter requires a response by a specific date, there are two main reasons you’ll want to. • you are due a larger refund; Or • the irs is. Web irs response letter template form: The response addresses two issues. • you owe additional tax; Web internal revenue service 310 lowell st. If your notice or letter requires a response by a specific date (typically it is 30 days), there are two main. Web if the notice or letter requires a response by a specific date, taxpayers should reply in a timely manner to:. Web newsletter tax insider irs notice response tips everyone should know these 13 tips can help practitioners and.Irs Audit Response Letter Sample 2021 lynashanbb

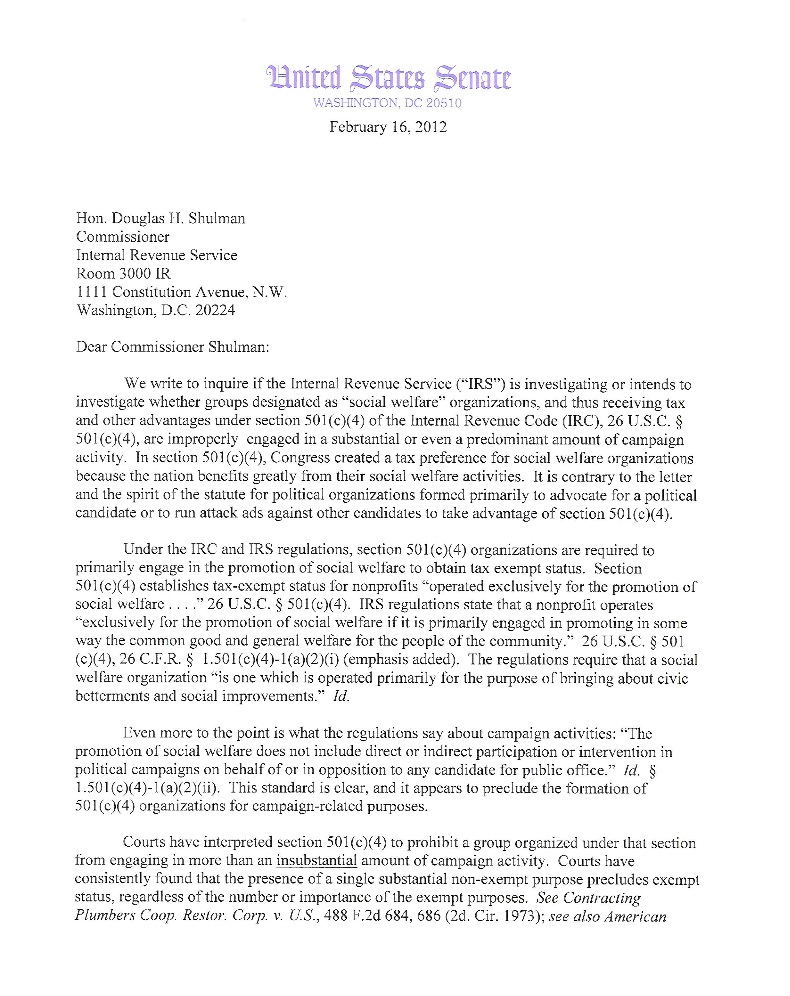

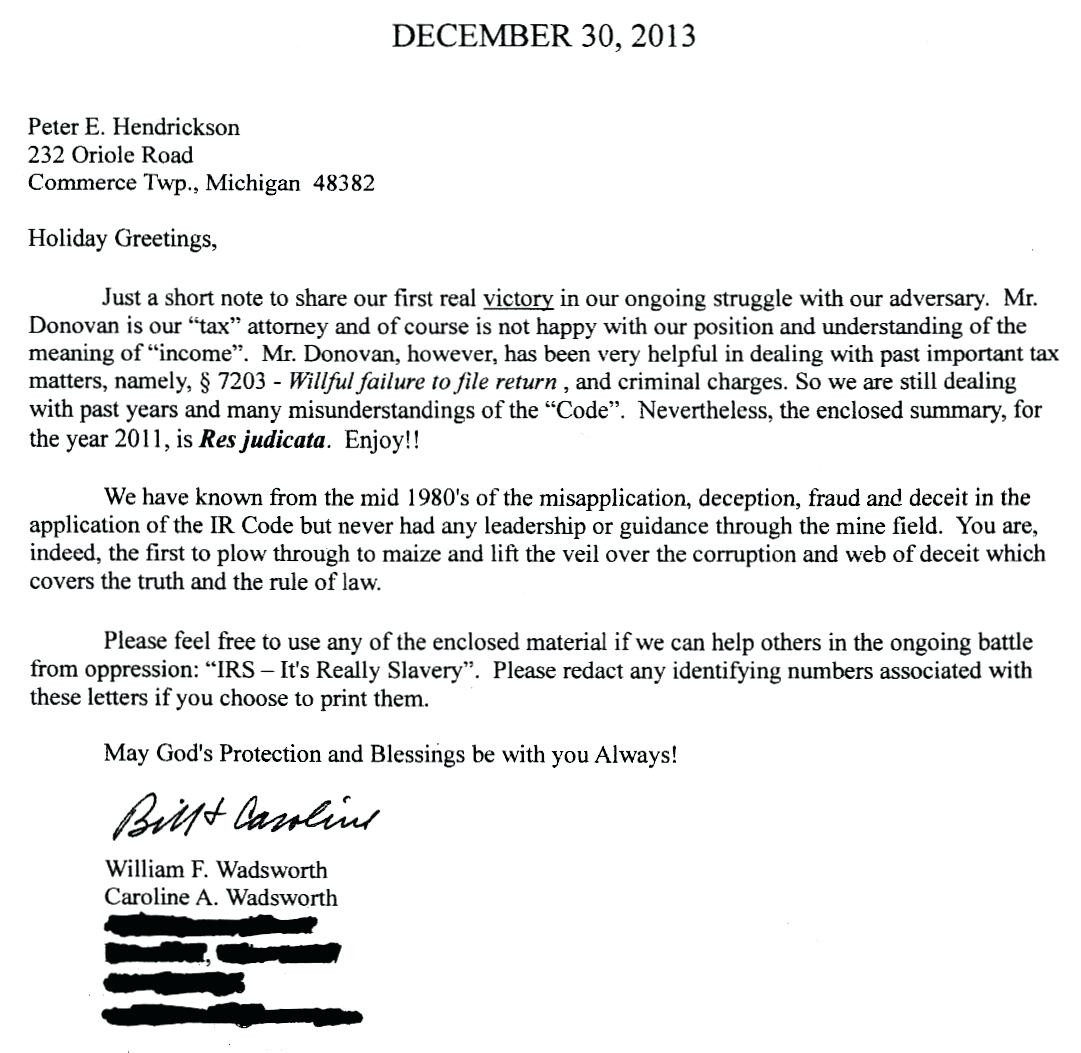

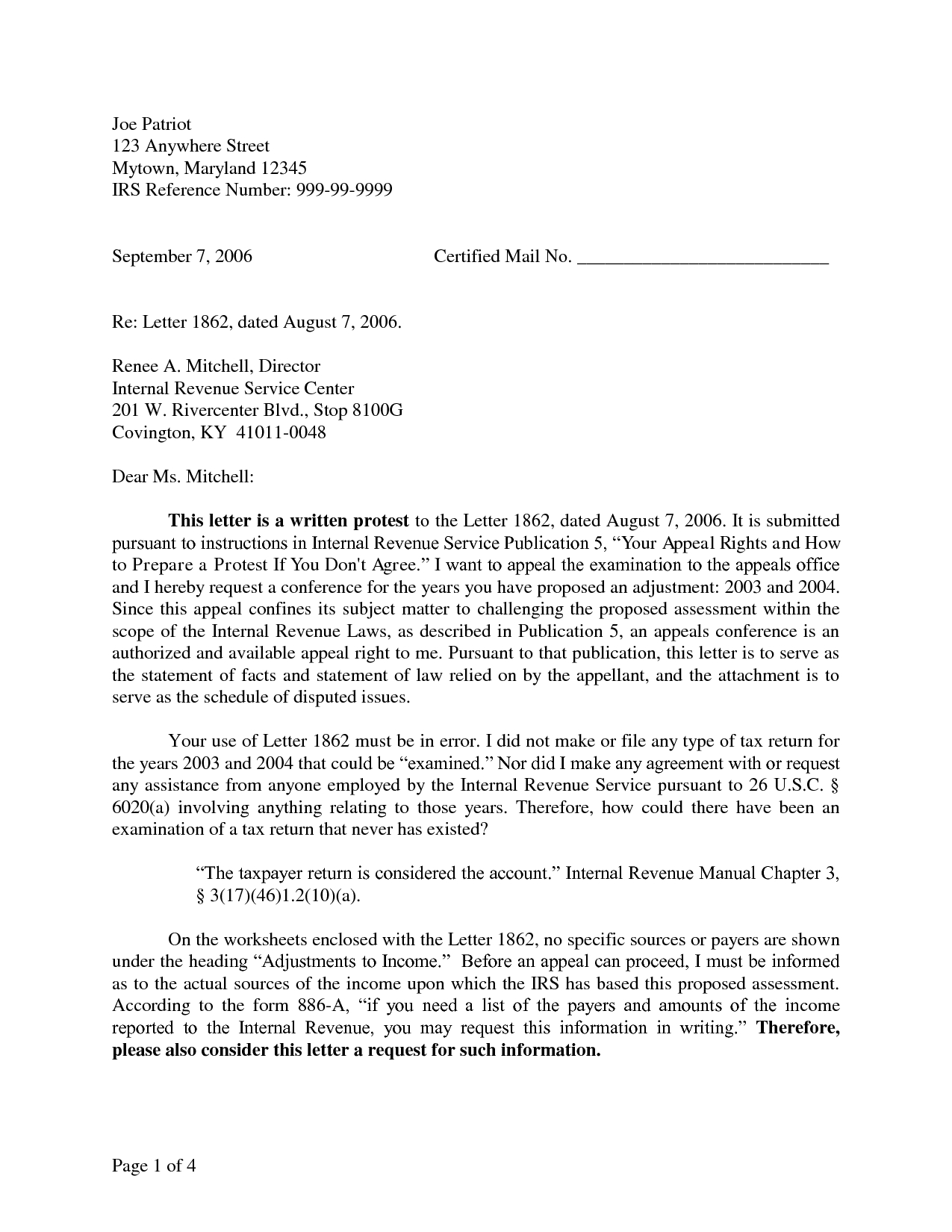

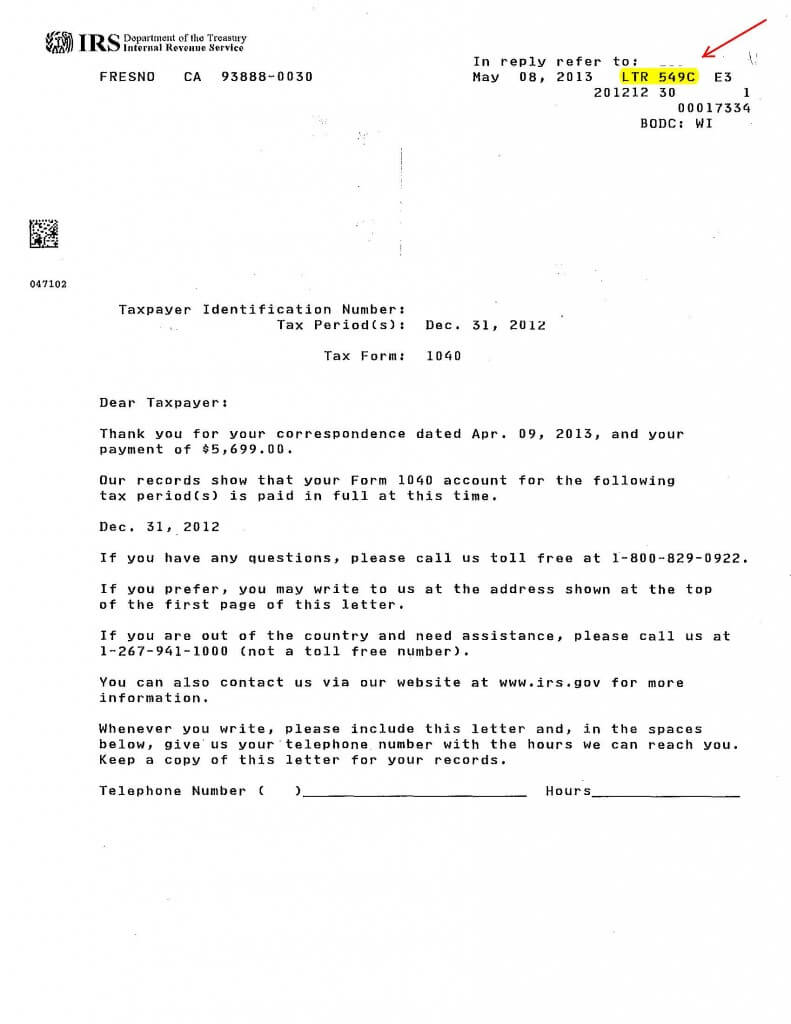

Sample Letter To Irs Sample Business Letter

[View 44+] Sample Letter Format To Irs LaptrinhX / News

Letter To Irs Free Printable Documents

Irs Response Letter Template Samples Letter Template Collection

Irs Response Letter Template Samples Letter Template Collection

Irs Response Letter Template Samples Letter Template Collection

Calaméo Irs Letter Response

Irs Cp2000 Example Response Letter amulette

Irs Response Letter Template Samples Letter Template Collection

Related Post:

![[View 44+] Sample Letter Format To Irs LaptrinhX / News](https://www.flaminke.com/wp-content/uploads/2018/09/irs-cp2000-response-form-pdf-awesome-outstanding-payment-letter-template-collection-of-irs-cp2000-response-form-pdf.jpg)