Schedule C Expenses Template

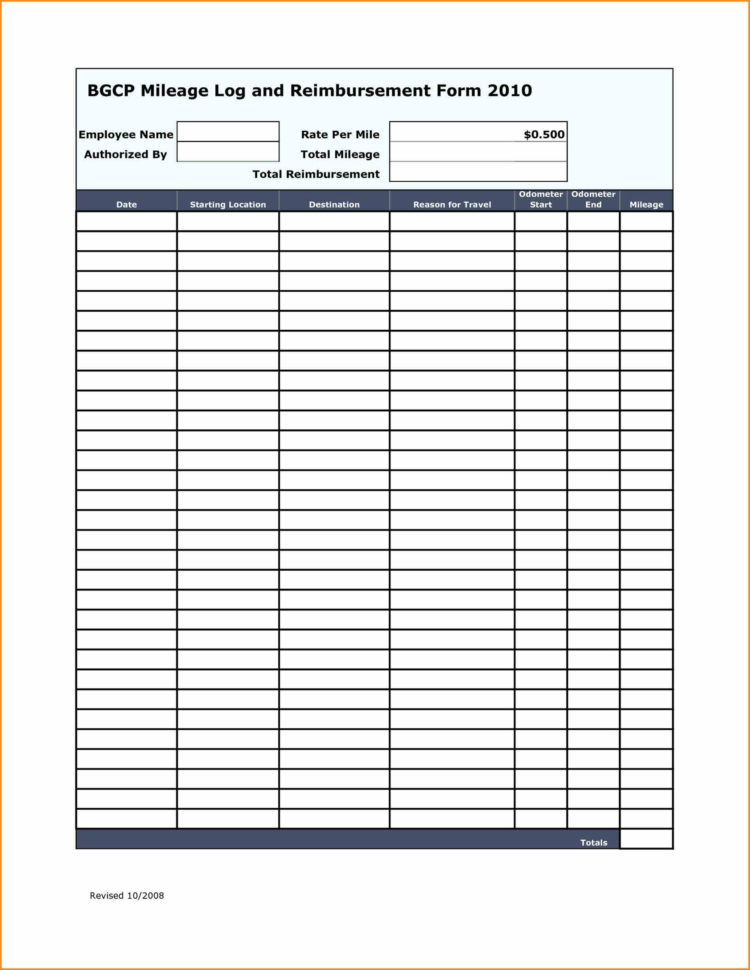

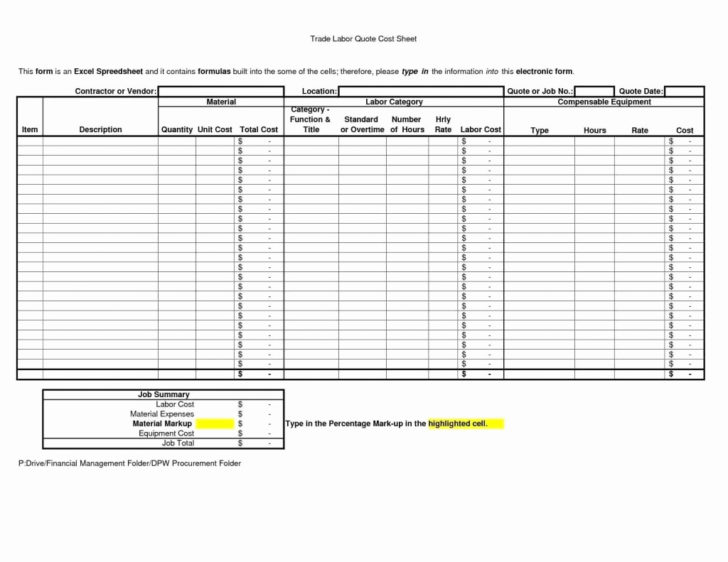

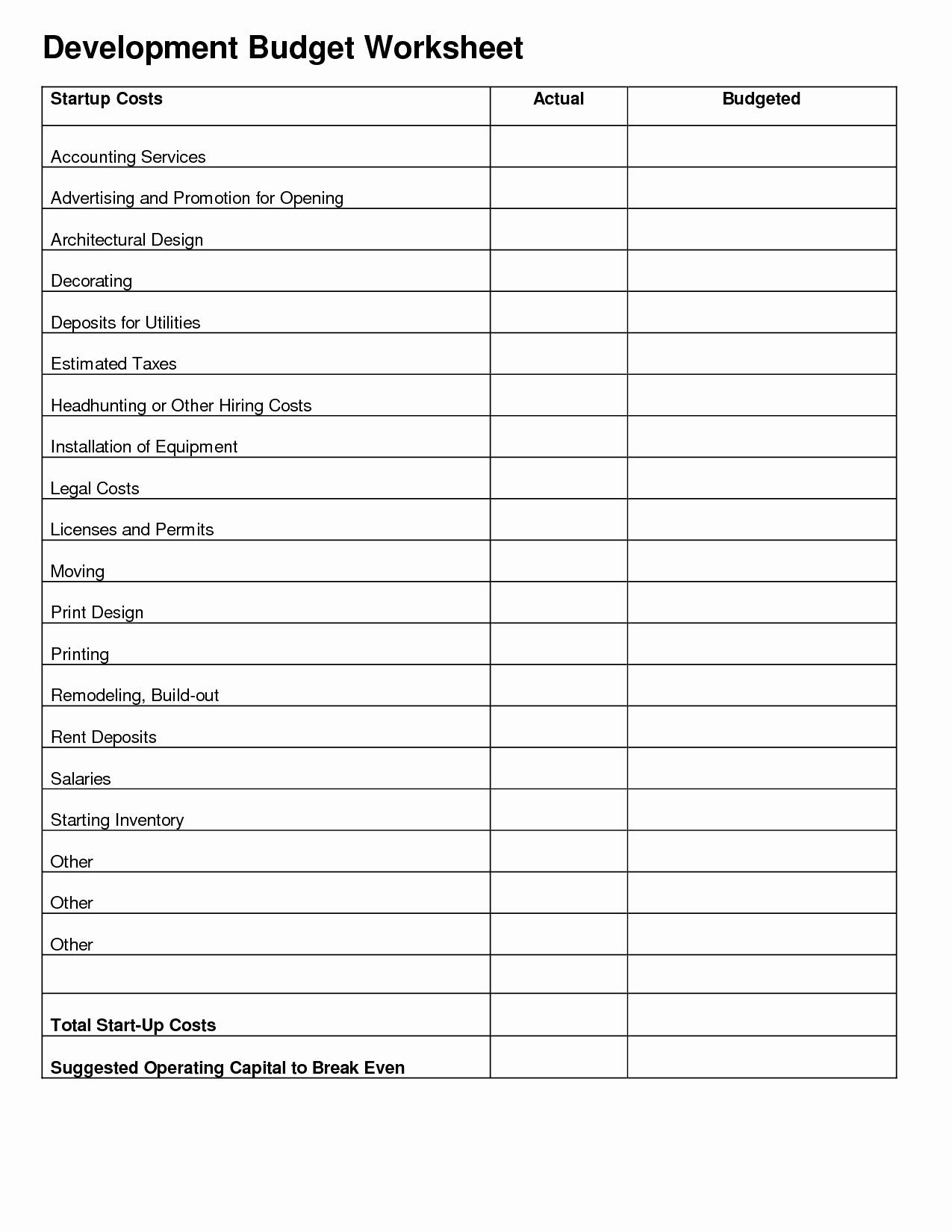

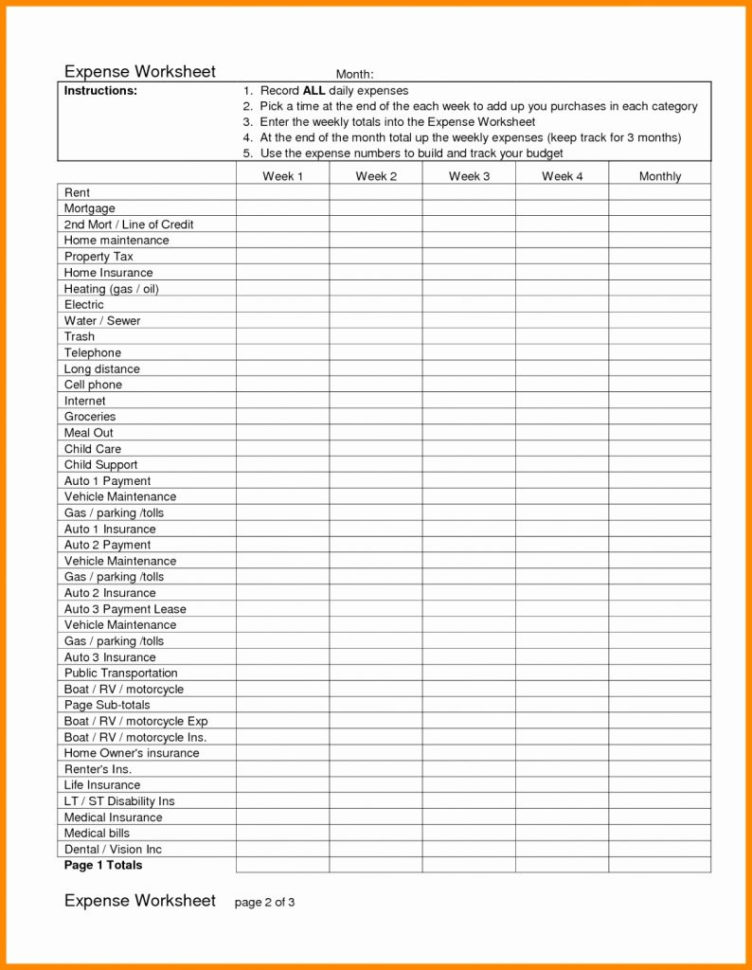

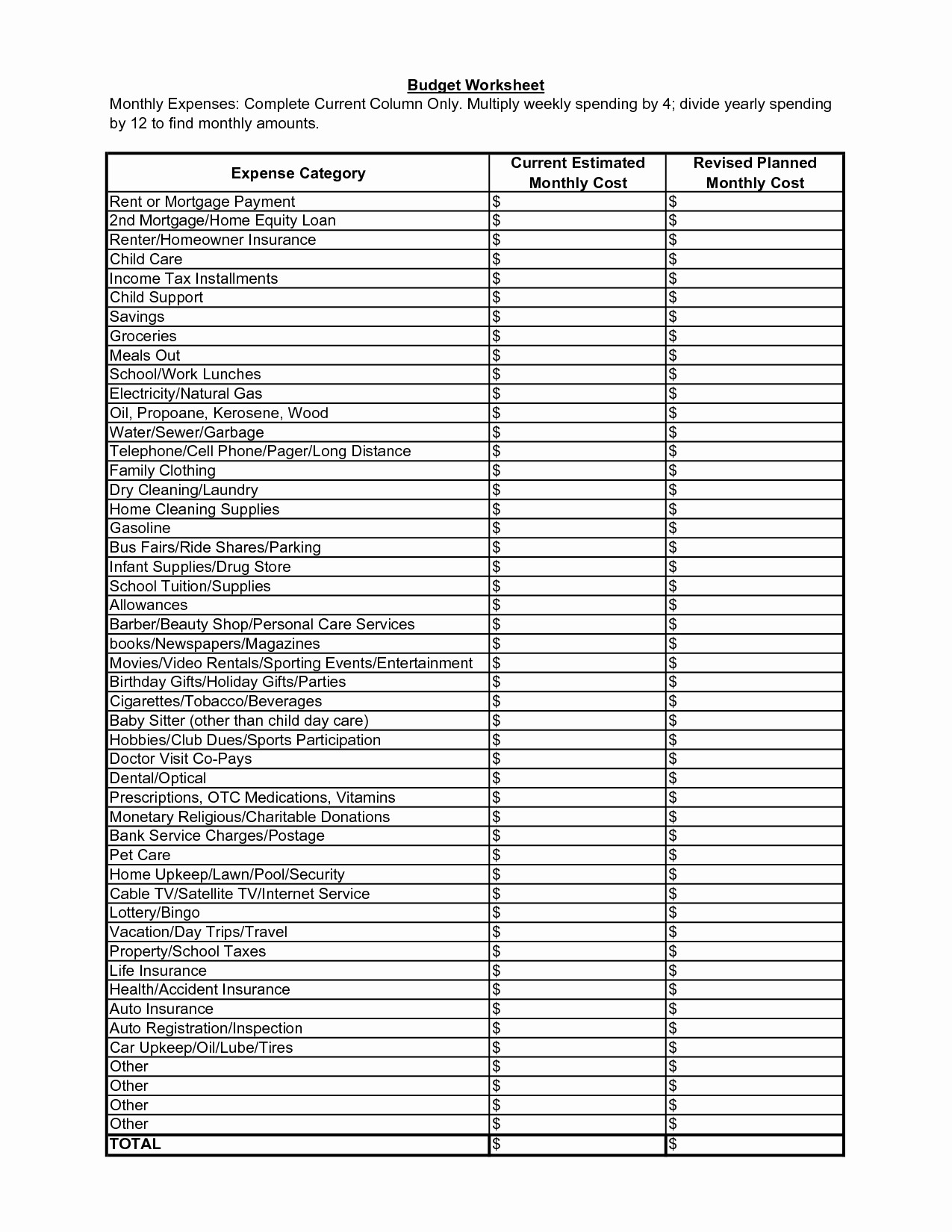

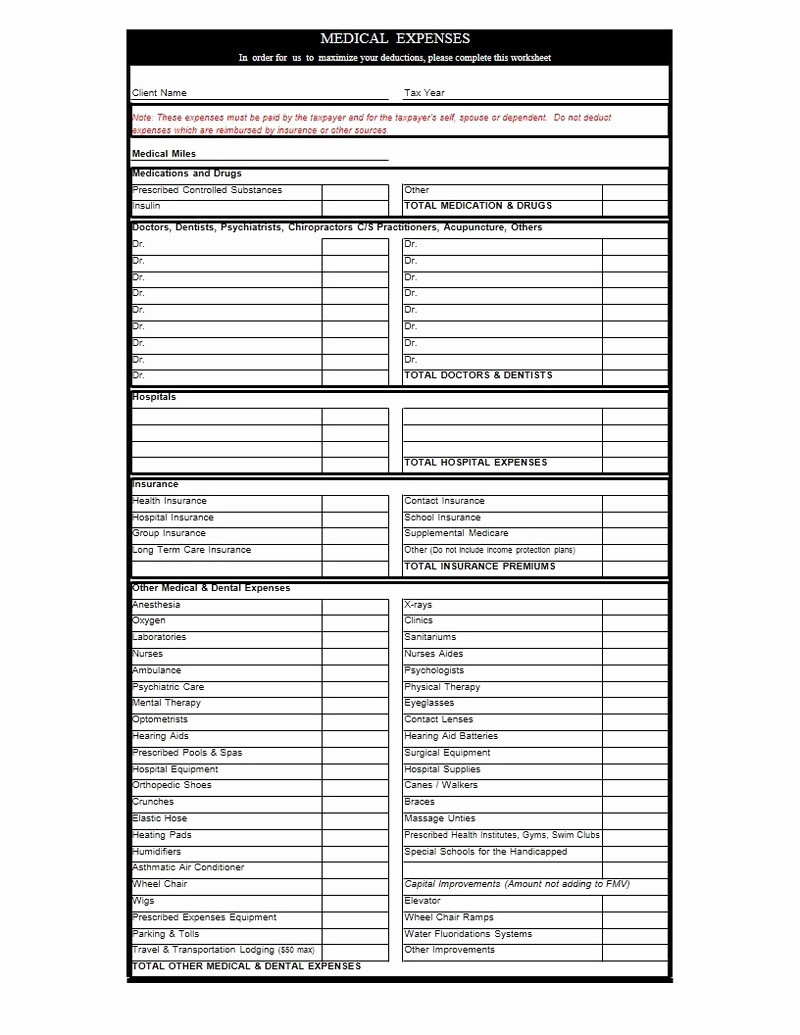

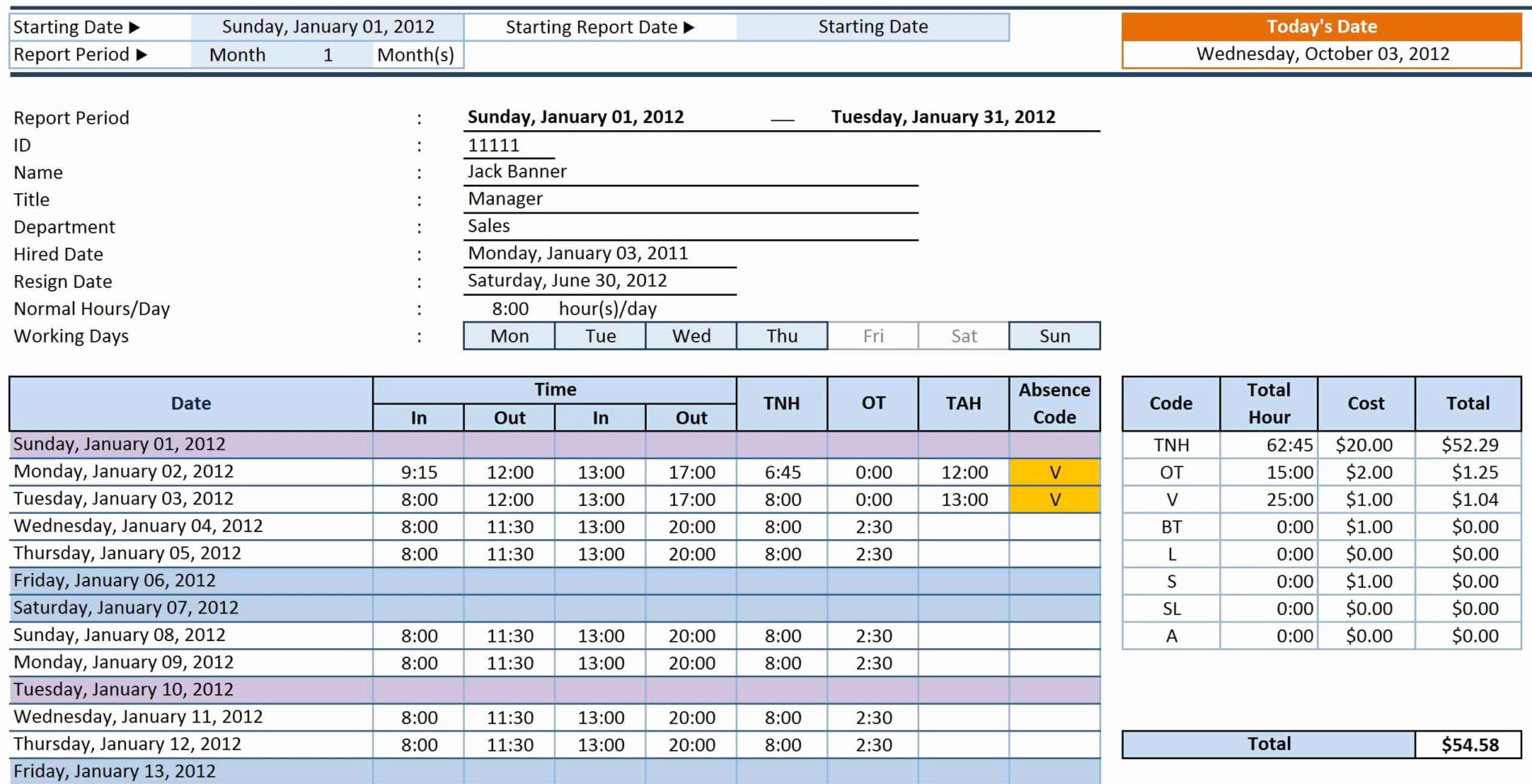

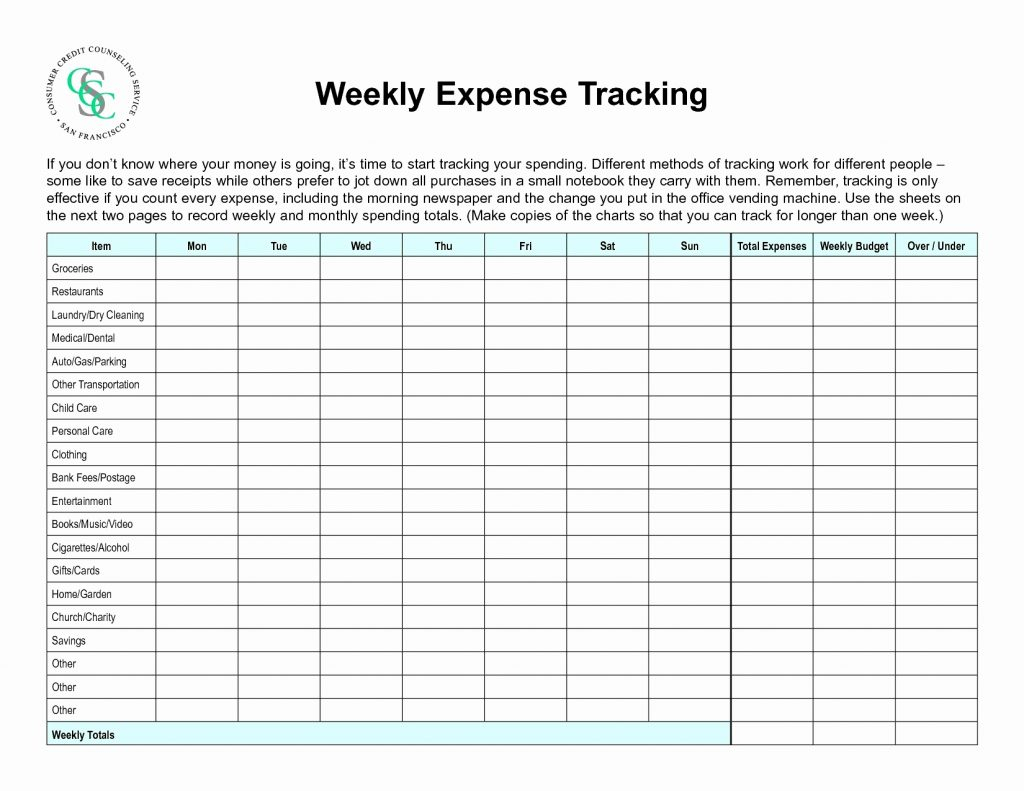

Schedule C Expenses Template - This schedule c tax form is to file net profit from proprietorship business. Web the schedule c report template is one of the default xero report templates available to your practice. Web to complete irs schedule c—the form most small businesses need to fill out to state their income for tax purposes—you'll need to. Web sole proprietors in the united states use schedule c (form 1040) to report business income and expenses. Profit or loss from business. Taxpayers by the internal revenue service (irs) department to report the profit or. Get out your shoebox of 2022 receipts and let’s get organized. Web schedule c (form 1040) department of the treasury internal revenue service. Web expenses or collections of receipts to organize or subtotal your expenses for you. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated. Web to complete irs schedule c—the form most small businesses need to fill out to state their income for tax purposes—you'll need to. The expense categories used on the. This schedule c tax form is to file net profit from proprietorship business. Profit or loss from business. Web schedule c (form 1040) department of the treasury internal revenue service. Web schedule c (form 1040) department of the treasury internal revenue service. Get out your shoebox of 2022 receipts and let’s get organized. Web the schedule c report template is one of the default xero report templates available to your practice. Web the standard mileage rate for 2022 is 58.5 cents per mile from january 1, 2022 to june 30,. This schedule c tax form is to file net profit from proprietorship business. Web the schedule c report template is one of the default xero report templates available to your practice. Web expenses or collections of receipts to organize or subtotal your expenses for you. Web schedule c (form 1040) department of the treasury internal revenue service. Web common schedule. Web a schedule c form is a supplemental form that is sent with a 1040 when someone is a sole proprietor. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a. Web expenses or collections of receipts to organize or subtotal your expenses for you. Web this spreadsheet helps you track everything you buy for work and groups them according to their appropriate tax category. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own. Web common schedule c expenses for sole. Get out your shoebox of 2022 receipts and let’s get organized. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole. This schedule c tax form is to file net profit from proprietorship business. Web download the excel worksheet here sole proprietors: Profit or loss from business. Learn about schedule c categories and. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated. Web sole proprietors in the united states use schedule c (form 1040) to. Web common schedule c expenses for sole proprietorship xne financial advising, llc is a financial service company that focuses. Web a schedule c form is a supplemental form that is sent with a 1040 when someone is a sole proprietor. Web schedule c is a tax form issued to u.s. Taxpayers by the internal revenue service (irs) department to report. Web common schedule c expenses for sole proprietorship xne financial advising, llc is a financial service company that focuses. Web to complete irs schedule c—the form most small businesses need to fill out to state their income for tax purposes—you'll need to. Web this spreadsheet helps you track everything you buy for work and groups them according to their appropriate. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own. Web the standard mileage rate for 2022 is 58.5 cents per mile from january 1, 2022 to june 30, 2022 and 62.5 cents per mile from july. Web download the excel worksheet here sole proprietors: Web a schedule c form is. Web expenses or collections of receipts to organize or subtotal your expenses for you. This schedule c tax form is to file net profit from proprietorship business. Web this spreadsheet helps you track everything you buy for work and groups them according to their appropriate tax category. Web download the excel worksheet here sole proprietors: Profit or loss from business. Web ðï ࡱ á> þÿ ‡ þÿÿÿþÿÿÿ. Web common schedule c expenses for sole proprietorship xne financial advising, llc is a financial service company that focuses. Web schedule c is a tax form issued to u.s. The expense categories used on the. Web a schedule c form is a supplemental form that is sent with a 1040 when someone is a sole proprietor. Web the standard mileage rate for 2022 is 58.5 cents per mile from january 1, 2022 to june 30, 2022 and 62.5 cents per mile from july. Web schedule c (form 1040) department of the treasury internal revenue service. Taxpayers by the internal revenue service (irs) department to report the profit or. Web to complete irs schedule c—the form most small businesses need to fill out to state their income for tax purposes—you'll need to. Learn about schedule c categories and. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own. Web sole proprietors in the united states use schedule c (form 1040) to report business income and expenses. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole. Get out your shoebox of 2022 receipts and let’s get organized. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated.Schedule C Expenses Spreadsheet —

Schedule C Expenses Spreadsheet Download Laobing Kaisuo —

Schedule C Expenses Spreadsheet Or Schedule C Car And Truck —

Schedule C Expenses Worksheet —

Schedule C Spreadsheet pertaining to Schedule C Expenses Spreadsheet

Schedule C Spreadsheet Of Schedule C Expenses Spreadsheet —

Schedule C Expenses Worksheet —

Schedule C Expenses Spreadsheet Of Schedule C Expenses —

Schedule C Expenses Spreadsheet —

Schedule C Spreadsheet within Schedule C Expenses Spreadsheet Car And

Related Post: